Recent days,Debt mutual funds are gaining popularity.At least numbers of folios and Asset under managements of these funds suggested by different fund houses affirms so.

In general,debt funds do not bear stock market volatility and more tax efficient compared to fixed deposits.Though these funds do not offer any guaranteed returns one can expect returns comparable to fixed deposits . Today we will take a look at different types of debt mutual funds.

- Income funds: Income funds are suitable for investors with medium to longer term investment horizon of 12 months and more.Income funds mainly invest in debt securities of varying maturities i.e. both short and long term debt instruments like Government / corporate bonds,Securitized debt,money market instruments.

- Bond Funds:The primary investment objective is to generate optimal returns with moderate level of risk.Allocation may include Corporate and PSU bonds,Govt Securities ,Money market instruments,securitized debts of varying tenors.These types of funds intend to take views on short to medium term interest rates and invest accordingly.In general NAV of bond funds is volatile compared to other debt funds.

- Gilt Securities funds:These funds predominantly invests in portfolio comprising of securities issued and guarenteed by central / state governments.hence has a very low credit risk profile.

- Floating rate funds:These are like ultra short term funds where allocation is predominantly in debt securities and floating rate instruments.Suitable for investors with holding period of at least 3-6 months.

- Short term funds:These types of funds are suitable for investors with short to medium term investment horizon of 6-9 monthsand medium risk appetite.These types of funds normally maintains a moderate maturity of the portfolio between 1-2 Yrs.

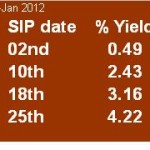

- Interval funds:These types of funds open for subscriptions on specified transaction days.Series available will be from monthly to annually and depending on the duration suitable portfolio allocation is done .Scheme remains closed for subscription for remaining days.

- Monthly Income Plans:These are hybrid types of funds where equity allocation can go upto 20% (sometimes 30%).This fund is suitable for investors having marginal equity risk appetite.Time horizon should be ideally 2-3 yrs.Its good combination of stability with dash of equity power.Monthly income is through dividends payouts (which is not assured).Dividend distribution tax is payable by mutual funds and its tax free in hands of investors.

- Fixed Maturity Plans:These are closed ended plans available for subscriptions time to time.Though returns are not known earlier these are considered to be best option against fixed deposits.Liquidity can be available through dividends or can be sold online through secondary market.

In debt funds manager try to achieve an optimal risk return balance for management of fixed income portfolios.These instruments carry risks like interest rate risk,liquidity risk,default risk etc and not totally risk free.Investors having already sufficient exposure in fixed deposits and are in high tax brackets can think to invest debt types of funds.

Also View: