Few years back LIC was launched couple of highest NAV guaranteed plans & today we will take view of performance of two funds & highest NAV of LIC Wealth Plus & Samridhi Plus as in May, 2013.

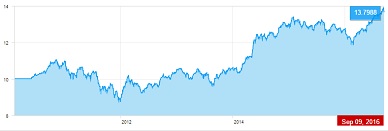

LIC Wealth plus:

Update as on 13-09-2016 : Highest NAV of LIC wealth Plus recorded 13.7988 on Sept 09, 2016.

LIC Wealth Plus was launched on 09th Feb 2010 & NAV chart of LIC wealth plus is as below:

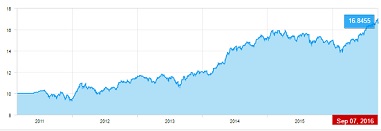

LIC Samridhi Plus NAV Chart:

Update as on 13-09-2016 : Highest NAV Update of Samridhi Plus : 16.8455 recorded on Sept 07, 2016.

LIC Samridhi Plus was launched on Feb 25,2011:Policy holder will receive the fund value based on highest NAV within first 100 months or at the maturity which one will be higher.

Chart source: www.indiainfoline.com

One can view that both LICs plans have shown disappointment at least till now..

Both of the plans have their own charges apart from charges inclusive in NAV .. considering these charges which are not inclusive of NAV & deducted separately I suspect policy holder should be in loss and may be continued to be same in future as well.

I have invested 75,000 in Wealth Plus Policy in 2010. I just want to know what is the present status.

Please reply in my email id that i provided please.

amarchaudhary59@gmail.com

i inves im samridhi

plus Rs 50000

what is the curenl NAV

I am invested Rs. 60,000/- in Wealth Plus Policy in 2010

What is Present status.

Please reply in my email address agrawal_milan@rediffmail.com

I am invested Rs. 60,000/- in Wealth Plus Policy in 2010

What is Present status.

Please reply in my email address.

I have invested 50,000 in samridhi Plus Policy in march 2011. I just want to know what is the present status.

Please reply in my email id that i provided.

Dear Sir,

I have invested a sum of Rs. 50,000/- as one time investment in ‘LIC SAMRIDHI PLUS ’ during march 2011. Now I want to en cash this policy.

Please communicate how much amount will be refunded.

Invest 1300000 in2010 this single primium now what is market value plz informe me

I have invested 60,000 in Wealth Plus Policy in 2010. I just want to know what is the present status.

Please reply in my email id that i provided.

I have invested 60,000 in Wealth Plus Policy in 2010. I just want to know what is the present status.

Please reply in my email id that i provided.

Dear Sir,

I have invested a sum of Rs. 50,000/- as one time investment in ‘LIC JEEVAN SAMRIDHI PLUS NAV’ during Feb 2011. Now I want to en cash this policy.

Please communicate how much amount will be refunded.

Sir,You need to contact LIC office or LIC agent for the same.

Regards.

I am invested Rs. 90,000/- in Wealth Plus Policy in 2010

What is Present status.

Please reply in my email address.

Sir,

You need to contact LIC office or your agent for current status.

Regards,

I am invested Rs. 60,000/- in Wealth Plus Policy in 2010

What is Present status.

Please reply in my email address.

I invested rs40000 single premium suggest me should I surrender or continue if I surrender how much value I’ll get its maturity is 2018 and policy started on2010 or 2009 approx suggest

Dear Sir,

I had invested Rs.30,000/- on 28/03/2011 in LIC Samridhi Plus. sarender this policy is it is the right time for me.

Please guide me.

Thanks & Regards

pappu singh

Dear Sir,

I had invested Rs.30,000/- on 28/03/2011 in LIC Samridhi Plus.

Now I want to surrender this policy is it is the right time for me.

Please guide me.

Thanks & Regards

pappu singh

I am invest 45000rs in simridhi plus what is current status

Dear Sir,

Today my 5 year is complted for smtudhi plus current valus is 90000 & i have paid 80000 so what are you doing for this continue or surrender the policy.

please suggest me.

Hitesh jain

9722xxxxxxxxx

i m investing every month 6000 from march 2011 to till the date could you please tell me the value as of now

Dear Prem,

Same problem for me So you are what are you doing,

please sussget me.

I am invest 60000/ in welth plus police no 579273642, what is the current status

I have investmen in lic samridhi.i have 8800 units now.the highest nav till is 15.87.i Wii get nav multiple to unit? That is 8800×15.87

Hi,

You need to check about external expenses which are not part of NAV. These expenses will be charged separately.

Thank you.

Hi sir I would like to know ,what is your view on the performance of LIC samridhi plus .thank you

I am invest rs 50000 in lic samridhi plus as on 15 may 2011.what is the current status.please infrom me.

Hi Manas

you need to contact your LIC agent ,LIC office for current valuation.

Thank you.

Sir, my self amit form bluechip corporate investment centre Ltd. .plz send me policy no. I will be services all investment product.

Just multily ur units with the current nav value

Dear Admin Saving-Ideas,

Let’say my ULIPs NAV value at the end of the term is 50 (8 years). What would be the approximate fund value at the end of the term for a policy of 1,00,000 (single premium). I know there are lot of other charges and please consider these as well.

Thanks.

Hi Suresh,

In this scenario,Fund Value can be around 4 Lakh.

But for this fund need to provide around 22-23% CAGR returns over a period of 08 years which seems very much difficult.

Thank you.

Dear sir,

i have invested 1 lakh rupees on samridhi plus policy on 18 -05-2011.

kindly inform me the current status of my policy

in terms of Rs. today.

Hello,

Dear sir,

i am invest 50000 in LIC SAMRIDHI PLUS…

so what is the status of this scheme…

if i want to surrender my current plan..

so it is right time ,can i getting right benifit…on my principal amount?

&

how u calculate ?

pls know me sir in details….pls

Dear Sir,

I had invested Rs.40,000/- on 28/03/2011 in LIC Samridhi Plus. At present the NAV of Rs.12.60.

Now I want to surrender this policy is it is the right time for me.

Please guide me.

Thanks & Regards

Manish K. Pancholi

Thanks for all those information. I just would like to know if supposed 11.8 is the highest NAV after 8 years can you tell me what is approximately percentage return on the investment after deductible charges.

Hi,

Its really difficult to predict about maturity value but it may not beyond principle invested.

Thank you

how much loan one can get in wealth plus policy. I had invested 2 lakhs in welth plus. How much loan can i get now.

hi Yakub,

loan value will depend on current fund value.You need to contact LIC office.

thank you.

i have invested 60,000 in LIC samridhi plus scheme in three equal annual installments of rs.20,000 each. What is the present performance of this policy.What if I quit by surrendering the policy.

Hi Saravana,

Its difficult for me to take any view at this point of time…

You can surrender if you have some clear plan about investment of same value in future..

Thank you.

Samrudhi plus is showing the absolute return 5.83% and highest nav till date is 11.96. I have invested 1lac in this policy. I want to know what is absolute return. Is this return is satisfactory or disappointing.

Hi Anand,

Returns are disappointing.Generally returns calculation is in terms of comppounded annual basis for returns of more than one year and if calculated compounded annual basis then returns are nowhere..considering other charges of policy.

thank you.

I have invested 60000 in LIC with 20000 X 3 years in wealth plus policy. What is todays amount ?

please give me answer on my email id.

regards.

Hi,

This is mere informational blog and we are not related to LIC anyway. For your fund value you need to contact with your LIC advisor from where you have purchased this plan.

Thank you.

I have invested 60000 in LIC with 20000 X 3 years in wealth plus policy. What is todays amount ?

please give me answer on my email id.

regards.

Hi i have invested 320000 in LIC samridhi plus plan i would like to know what can be expected return after 8 years from now ..or i should take out my balance fixed it as fd in bank where i am getting something around 2400 per month kindly suggest my no is 98324xxxxx

Hi ,

No one will able to tell how much will be returns of this plan in future.

You can take a view of surrender value and then decide about it..I am not sure how figure of Rs.2400 per month comes from..

Thank you.

If I make FD of 300000 then at the rate of 9.25% . I will receive 800 per month per lack

plz send me ur policy no

Dear Sir,

Can you guide me the advantage and disadvantages of of my following LIC policies :

Samridhi Plus 10 Year T 804 ( 3dr Year)

Jeevan Tharang : 10 year T 178 ( 1st year)

Endowment Assurance Policy 10 year T14 (3rd Year)

Market Plus T 191 ( 3rd Year)

Pension Plus T 803 ( 3rd Year)

Regards

Hi,

Discussing each policy will be time consuming but just I will add that Having so many insurance plans is not a good thing.I don’t think you should consider them ..result will be better even if you consider to take a term plan and go for recurring deposit with rest of amount..

Thank you.

I have invested 60000 in LIC with 20000 X 3 years in wealth plus policy. What is todays amount ?

I have invested 60,000 in LIC samridhi plus scheme in three equal annual installments of rs.20,000 each. What is the present performance of this policy.What if I quit by surrendering the policy.

Hi Japnam,

I don’t have exact idea about surrender value of Samridhi plus .

I think its better to remain invested in the plan at this stage.

thank you.

In wealth plus will one gets atleast what one invested at the end of 8 years because shares are getting deducted and nav value is not showing improvement.

What Is The Investment Source Of Samrudhi Plus Plan

Give Me Answer

Hi Prashant,

I was not able to reply as I was away.

Currently as far my info.this plan have 59% allocation in direct equity and rest in other mutual fund schemes of LIC MF,fixed deposits ,G-SEC and others…this investment structure can change as its dynamic.

I am not sure about future of this plan.But if you have invested then better to stay till maturity.

Regards.

Sarudhi plus graph is goging to flat what is Fututre of This plan

Hi,

One can’t guarantee any thing in future.It will all depend on performance of assets allocated by this fund.

Thank you.

i am invest 90000 in samrudhi plus what is the Current Status Of

Hi,You need to contact LIC office or agent for details of current fund value.

Thank you.

I invested 45000 single premiam what’s value in current Time

Sir,

You need to contact LIC office or LIC agent for the same.

Regards.

Thanks for giving updates of wealth plus nav value. What will be expected nav at the end of 8 years.

Yakub,

Can’t say exactly.

Regards.

yes