Reliance Home Finance – part of Reliance Capital Limited which is one of the leading private financial services company in India.

Reliance Home Finance has come up with an NCD issue in December 2016 which will offer both secured and unsecured NCDs. Company intends to raise Rs.3000 crore from secured NCDs & 500 crores from unsecured NCDs.

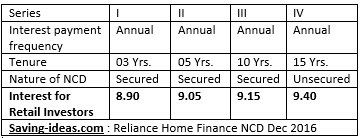

Details of Reliance Home Finance NCDs are as follows:

Imp Dates:

1.Issue open date:December 22, 2016.

2.Issue close date:January 06, 2017.

Interest rates:

Call option: Company can exercise Call option for unsecured NCDs after 10 years.Means company have an option to discontinue unsecured NCDs after 10 years & pay money back to investors s.t. regulatory approvals.

Other Details:

1.Credit rating for secured NCDs: CARE AA+ & Brickwork AA+.

2.Credit rating of Unsecured NCDs: CARE AA & BWR AA.

3.Only annual interest payout option across all series.

4. NCDs will be listed at both BSE and NSE.

5. 30% of issue size is reserved for HNIs and retail investors each.

6.Investor can opt NCDs in physical or demat mode.

Considering falling interest rate scenario, secured NCDs may be a good option for regular income in fixed income portfolio.Just investor should remember that they will not be able to redeem money before tenure except via secondary market.So choose tenure as per requirements in future.So considering good credit rating and better interest rates than fixed deposits, one can invest in this issue.

Though NCD offers good coupon rate, I find it risky, either government savings bond would be a good option, 8% return with soverign guarantee is an amazing combination.

yes…Private NCDs offer higher returns but comes with commensurate credit risk.But,considering low interest rate scenario, investors risk appetite is high and nearly all private NCDs have received good response.

Regards.