Just to give a look,what we have missed if not invested for last two decades.

Here we have compiled list of mutual fund schemes which are 20 yr old and have offered 20%+ returns in terms of CAGR -Compounded annual growth returns and IRR – if invested systematically.

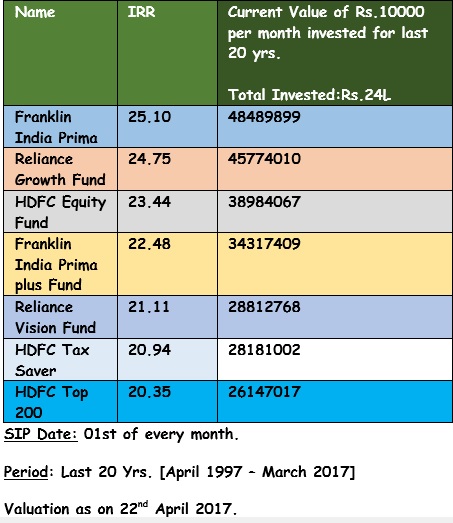

Schemes which have offered 20%+ IRR:

This table gives idea if any investor have invested Rs.10,000 per month since April 1997

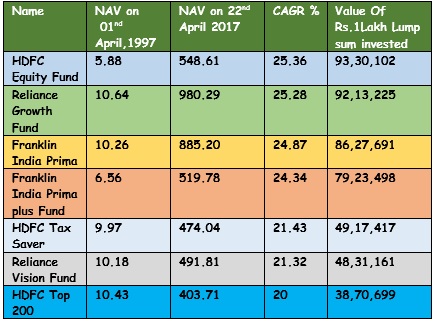

Schemes which have offered 20%+ CAGR:

CAGR is for lump sum investment of Rs. 1 Lakh made on April 01, 1997:

- Past performance of any scheme is not guarantee of future performance.

- We agree that two decades back Rs.10,000 per month was very high amount for retail investor to invest.

- Investor should not expect such high returns in future as economy have moved towards much more saturation in last two decades.

- Fund which have offered best in terms of IRR,may or may not offer same best performance in terms of lump sum investment.

- Mid cap funds have offered higher returns than large caps but with higher volatility.

- To optimize returns,One can use combination of SIP and lump sum.Invest lump sum when market becomes cheaper.

So,whats your view about equity for next decades?How do you invest in mutual funds?Do you think mutual funds will beat the broader market in future also?