Currently there are more than 40 asset management companies operating in India and in turn they have a number of schemes.In this case,investors have in general few options listed below:

- Study performance of difference schemes and take a decision.

- Hire an advisor.Pay him to select mutual fund schemes for you.

- Rely on agent and invest in schemes suggested by him.

- Invest in Fund Of Fund schemes of mutual fund.

Today,we will take look at Fund of Fund schemes of mutual funds,there benefits and disadvantages.

What are equity Fund Of Fund Schemes?

Equity FOF schemes invests in different equity mutual fund schemes of same and other mutual funds registered with SEBI.

By experience,I can observe that each FOF scheme invests in other 5-6 mutual fund schemes.

Though it looks easy investment,such schemes have their own pros and cons as listed below:

Pros Of FOF Schemes:

- Diversification:Each FOF invest in 5-6 different mutual fund schemes so it offers big diversification and reduces risk in a big way.In general investors prefer to have number of schemes in their portfolio,so FOF offers them package of different schemes with much more reduced paper work.

- It has been observed that FOF manager,invests fund across different AMCs rather than concentrating on funds of own AMCs.

- We can consider mutual fund manager as qualified and reliable person to chose different mutual fund schemes for you.

- Different options like aggressive,cautious are available for investors suitable to their risk profile.

- One can invest similar to other equity funds through lumpsum,SIP,STP way.

- In general,fund managers can take more dynamic decisions about exit / entry in specific mutual fund scheme than investor.

Cons Of FOF Schemes:

- Higher Expenses:These schemes have their own expenses so investors need to pay more expenses through expense ratio in the range of 0.5 – 1.5%… it is inclusive in NAV declared and not charged separately.

- Higher Exit loads:These funds in general carries higher exit loads than base schemes,nearly more than 0.5%.Most of the equity schemes carry exit load of 1% for exit within first year while in general ,FOF charges exit load of 1.5% for exit within first year.

- Tax Treatment: Equity FOF schemes are treated as Debt mutual Funds so investors need to pay a tax of 10% (without indexation) on capital gain received through these schemes.

Example Of Fund Of Fund Scheme:

We can take example of Quantum Equity Fund Of Fund scheme for reference.(Disclaimer:Blog Author is not related as distributor with Quantum mutual funds.)

Portfolio Of Quantum equity FOF:

- DSP Blackrock Equity Fund.

- HDFC Top 200.

- HDFC Equity.

- Canara Robeco equity diversified.

- Birla Sunlife Frontline equity.

- Sundaram Select Midcap.

One can view that its comprising of good equity diversified ,large cap and mid cap funds.

So when investor invests in Quantum FOF scheme ,actually he invests in above different schemes.

Scheme Performance:

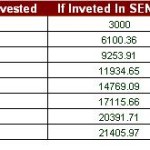

| Scheme | Performance Since Inception Date:20th July 2012. |

| Quantum Equity FOF | 8.16% |

| Sensex Performance for same period | Apprx 4% |

* Returns are on CAGR basis.

Bottomline:

So bottomline is:

Think to invest in FOF schemes if:

- You do not have much more resources and time to study about mutual fund schemes.

- You do not wish to rely on agent or IFA for scheme selection.

- You would like to pay 10% capital gain tax (without indexation) or 20% (with indexation).

- You have already have investments across diff mutual funds and looking for other investing way.