As per budget 2014,deduction of Rs.1.5 Lakh is now available from 2014-2015.For conservative investor Tax Saving Deposit is safe option.Today we have listed interest rates of few banks.

Majority of banks are currently offering interest rates in the range 9.00 – 9.25 for Gen depositors .

What are 80C Tax Saving Deposits:

Tax saver deposit is similar to general fixed deposits but comes with lock in period of 05 years.Principal amount get locked for 05 years.Depositor can chose different options like – Monthly interest payment,Quarterly Interest payment or Cumulative …depending on need of depositor.Interest income if reinvested is not eligible for 80C benefit.

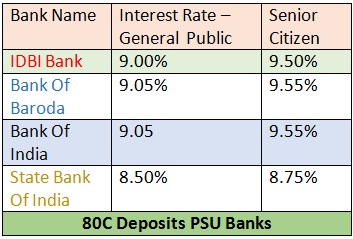

Interest rates – PSU Banks:

Except SBI most of the PSU banks offers interest rates around 9.00 %.

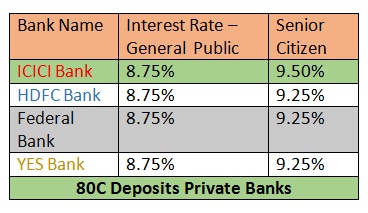

Private Banks:

Not quite much variation in deposit rates.

80C Deposits by HUDCO:

One can invest in HUDCO deposits of tenure 05 years and avail 80C benefit.Depositor need to mention whether he or she going to avail 80C benefit or not.

HUDCO is currently offering interest rate of 8.75% for General public and 9.00% for senior citizens.

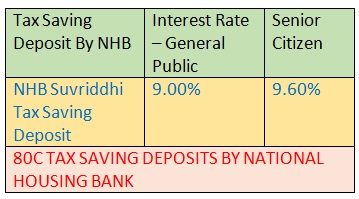

National Housing Bank – NHB Tax Saving Deposits:

NHB is apex bank under RBI and regulate Housing Finance Companies.

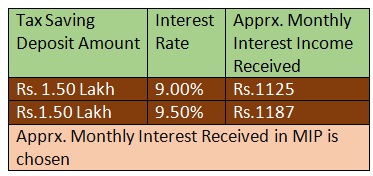

What will be your monthly interest income if opted for:

Consider scenario of 1.5 lakh deposited with interest rate of 9.00% and 9.50%

Depositor can chose either monthly,quarterly interest or cumulative option.

If you are safe investor and looking for deposit some amount in these deposits then try to make hurry as probability of interest rates going down is higher and as much early you deposit money,earlier will be maturity and money will be freed earlier from lock in period…isn’t it..