IFCI has now come up with next round of infrastructure bonds with slightly better interest rates than current IDFC and L&T issue.

Issue Details:

- Issue Open Date: 30th Nov.2011.

- Issue Close Date:08th Feb.2012.

| Options | 1 | 2 | 3 | 4 |

| Cumulative | Annual Interest | Cumulative | Annual Interest | |

| Tenor | 10 Yrs | 10 Yrs | 15 Yrs | 15 Yrs |

| Interest Rates | 9.09% | 9.09% | 9.16% | 9.16% |

| Buy Back | End of 5th/7th Yr | End of 5th/7th Yr | End of 5th/10th Yr | End of 5th/10th Yr. |

- For buy back,intimation needs to be given to registrar.For option 1 and 2 ,intimation period is sept 15th to Nov.14th of 2016 and 2018.For options 3 and 4,intimation period is 15th sept and 14th Nov of 2016 and 2021.

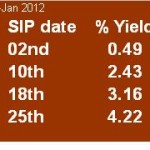

- Allotment date: 15th Feb 2012.

- Interest payment will be on 15th Feb each year.

- Rest details are similar to earlier issue.

To View how to download application form please CLICK HERE

sir i have purchesed IFCI INFRA BONDS-SRIES IV

IN 2012

anually interest is recived through post

please tell how to registered for E-communication so the interest can be tnansfer to my account. earlier all bank details and cancelled cheque has been sent to kavery computershare adress.

thanks

neeru jindal

dpid- id/filo no INB0301695

Hello,

Generally interest get credited via ECS. You can mail them about the reason- why ECS is not activated.If demanded once again send them all details along with cancelled copy of cheque. ECS should work if MICR no or IFSC Code is provided.

Regards.

You have send a message on my mobile that you have send 2 bonds IFCI Infra IV ON 15.02.2012. Please send in my e-mail adress, how I get status of this Bonds.

Thanking You.

Place:BK.T.P.P yours ever

Date:19/01/2013 Kausik Ghosh

You need to contact Registrars of the issue-Karvy Computershare Pvt Limited.

You can send them details of your application to their address or email them at:

einward.ris@karvy.com

To The Registrar, Karvy Computershare Private Limited.

Sir, I received your certificateNo.1105456 where my name is wrongly typed as… (furthur comment deleted by Blog Admin Due to personal information)

Sir,

I think it is not correct place to solve your query.You need to email the registrar.

I HAVE RECEIVED A MESSAGE FROM KARISMAKARVY.COM,YOU DISPACTED MY ALLOTED 4 BOND ON 15 FEB 2012 BUT IHAD NOT RECEIVED IT TILL TODAY ON 25-4-2012 APPLICATION NO;- 260212

i have received the SMS for allotment of IFCI infra bonds series v and informed that we can down load the allotment advice from karisma.karvy.com.But this page is not opening

My experience is that download link works after few days of allotment…..

I HAVE RECEIVED A MESSAGE FROM KARISMAKARVY.COM,YOU DISPACTED MY ALLOTED 4 BOND ON 15 FEB 2012 BUT IHAD NOT RECEIVED IT TILL TODAY ON 19-4-2012 APPLICATION NO;- 260212

I HAVE PURCHASED IFCI LONG TERM INFRASTRUCTURE BONDS-SCHEME IV RS.20000/- BUT WE HAVE NOT RECEIVED ORIGINAL BONDS TILL DATE. KINDLY CONFIRM TO US.APPLN NO. 1316761 & REF.NO.453489 ALLOTMENT DATE 15.02.2012.

Actually till issuers have not dispatched it….

Forms may available at website or with brokers…

Conditions about premature withdrawal are listed in the instructions section of the application form.

please send probable date for dispatched of my IFCI bonds under appln no. 1316761 ref.no. 453489 allotted on 15.02.2012.

please let me know where i can find ifci infrastructure bonds series 4 allotment status.

You can refer this post.

I HAVE RECEIVED A MESSAGE FROM KARISMAKARVY.COM,YOU DISPACTED MY ALLOTED 4 BOND ON 15 FEB 2012 BUT IHAD NOT RECEIVED IT TILL TODAY ON 12-3-2012 APPLICATION NO;- 554259

You can check allotment status here

If all details are correct then there is no need of worry.

i have received a message from karismakarvy.com . you dispacted my alloted 4bonds on15feb2012, but i had not received it till today on 27feb2012.. tell me how to download these bonds?application number- 808839

thanku

I had purchased Series 4 IFCI bond from HDFC bank on 6 jan 2012. But still not i have not yet recieved it.

Please let me know what time period for bond to be issued?

Or anywhere i can check the status of it?

And for next period when to invest it?

Regards

Ravi

Today I received the SMS for allotment. In this its also indicated that we can download allotment advice from ww.karisma.karvy.com. Currently this page is not opening.

Check here:

http://www.saving-ideas.com/2012/02/allotment-statusifci-series-4-and-rec-80-ccf-infrastructure-bonds/

i have lost my receipt so i need to print allotment status for ifci infrastructure bonds series 4.

Your reply will be appreciated.

IFCI allotment is on 15th Feb 2012.

please let me know where i can find ifci infrastructure bonds series 4 allotment status.

WHEN I WILL GET MY BOND OF IFCI SERIES IV FOR APPLICATION NO 189502

I am Interested , and living in delhi

please mail the T&C..n send me the no. of Agent of your agency.

I am Interested & on urgent basis.

please mail the T&C..n send me the no. of Agent of your agency.

I want to invest in IFCI Infrastructure bond. Could you please help me on the following queries?

1. If I go with option 4, i.e. for 15 year Annual (9.16%) interest rate; Interest will get created every year by 9.16% ?

2. For the above option if I take back money after 5 year? How much deduction will happen ? Can I get my all principle amount back?

a. If Yes then everyone will try for 15 years option only right and they will withdraw after 5 year, by taking more interest.. Right? Please clarify the same.

Hi,

One can withdraw money after 5 yrars for any of the option.There will not be any fine on buy back value after 5 years.Its not true that everyone will opt for tenor of 15 yrs,, as by chance anyone skip exit window after 5 yrs,,another window will be only after 10th year,,unlike after 7th yr for 10 year bonds.

As well,,there is not much difference in maturity values for 9.09% and 9.16% for investment of Rs.20,000/-.

I am based on Bangalore. Any Agent details pls.

I want invest 20,000 in infrastructure so please suggest.

I am in Baroda,Gujarat .Need agent /Intermediary details

I am based in Bangalore. Where to buy this IFCI bond?

Please include my mail id in mailing list to hear more about this.

Nice and quick information, thanks

Welcome!!!

Thanks 🙂