One of my friends father invested Rs 1Lac in single premium pension plan before 10 yrs.The vesting date is about six months from today and fund value is near to 1.80 Lac.Now what options he have? We will take a look at it.

A)Complete the term & Take Pension:

First choice is to complete the term and take pension benefits as per your choice from different options.One may delight after hearing the word “Pension” and it will take care of retirement.But first take a look of what amount one can get as a pension.

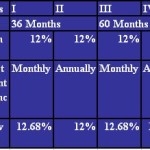

Following are different choices and annuity received for purchase price of Rs. 1lakh…Rates are average and may slightly differ from one to another annuity provider.

1.Life annuity without return of purchase price:

In this option,policy holder will get pension benefit till he is alive and purchase amount (fund value) will not be refunded.

| Purchase Price(Rs) | Annuity Payment Option | |||

| Monthly(Rs) | Quarterly(Rs) | Half-yearly(Rs) | Yearly(Rs) | |

| 1 lac | 635 | 1950 | 3990 | 8,150 |

2.Life Annuity With Return Of purchase price:

Policy holder will get annuity for life and fund value will be returned to the nominee.

| Purchase Price | Annuity Payment Option | |||

| Monthly | Quarterly | Half-yearly | Yearly | |

| 1 lac | 455 | 1450 | 2,975 | 6,050 |

3.Joint Life survivor without return of purchase price:

Pension is purchased by couple and received till either one is alive.No refund of purchase price.

| Purchase Price | Annuity Payment Option | |||

| Monthly | Quarterly | Half-yearly | Yearly | |

| 1 lac | 475 | 1485 | 3,025 | 6,150 |

4.Joint life survivor with return of purchase price:

Annuity is purchase jointly with spouse and is received till anyone is alive.Purchase price is refunded to nominee thereafter.

| Purchase Price | Annuity Payment Option | |||

| Monthly | Quarterly | Half-yearly | Yearly | |

| 1 lac | 450 | 1405 | 2855 | 5,800 |

Along with these options other options like annuity guaranteed for first 5,10 or 15 yrs and life thereafter is also available.

B)Surrender The Policy:

If anyone feel that annuity rates are low then he can surrender the policy before vesting or mature date.Its not possible to surrender the policy after vesting date and take fund value.Fund value remains invested to company till you provide annuity option to them.It is mandatory to take annuity thereafter.So if anyone wish to surrender, do it before policy mature date and invest this money in monthly income plan of posts with 8%,monthly interest schemes of banks or senoir citizen saving scheme with quarterly interest payment with 9% p.a.If you think that market conditions are favorable then invest in mutual fund schemes and after enough appreciation go for MIPs etc.

In India,till banks or posts offering better rates it seems a bad idea to take annuity.so finally investor need to take decision depending upon his needs.

I HAVE ICICI PRUDENTIAL LIFE INSURANCE POLICY LIFETIME SUPER PENSION.

I HAVE PAID TOTAL PREMIUM AMOUNT Rs 300000/- MATURITY DATE IS 13/03/2017.

I MAY GET ABOUT RS 750000/-AT THE TIME OF MATURITY.

1/3RD AMOUNT WILL BE GIVEN TO ACCOUNT HOLDER IMMMIDIATELY AND REMAINING 2/3RD AMOUNT WILL BE INVESTED IN ANNUITY.

MY DOB IS 05/11/1942.I WANT TO KNOW WHICH IS BEST SCHEME FOR ME & WHICH COMPANY WILL BE BETTER

SUCH AS NPS, LIC,ICICI,HDFC, AVIVA INDIA LTD., ETC.

PLEASE INFORM HOW MUCH APPROXIMATE AMOUNT I WILL GET AS A PENSION at the present rate

THANKING YOU

REGARDS,

PARMANAND JETHANI

Hello,

Thank you for comment.

You can purchase annuity from ICICI Prudential itself.You can decide about it after receiving quotation of same from company.

Its difficult to predict interest rate scenario in 2017.But Considering annuity purchase amount of Rs, 5 Lakh and assuming annuity rate @7.5%, one get annuity of Rs.3100 per month.

Thank you.

Very informative. It is not easy to choose annuity or any other instrument of future return. Never know how this inflationary trends that time. It looks vast private sector employees without secure post-retirement, life seems risky

Sundar,

You are true saying that its difficult to choose products for retirement.Answer is proper asset allocation and some risk taking.