About Company:

PTC India financial services[PFS],is promoted by PTC India Ltd to provide the financial solutions to the projects like Energy value chain,power projects in generation,distribution, transmission,fuel sources,equipment manufacturing and EPC projects.

Issue Details:

- Issue Open Date:29th Dec.2011.

- Issue Last Date:29th Feb 2012.// Issue last date is extended till 27th march 2012.

- Allotment date:16th March 2012.

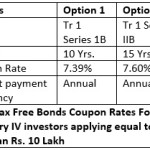

Rate Of Interest:

| Options | 1 | 2 | 3 | 4 |

| Frequency Of Interest payment | Annual | Cumulative | Annual | Cumulative |

| Tenor | 10 Yrs | 10 Yrs | 15 Yrs | 15 Yrs |

| Lock-in Period | 5Yrs | 5Yrs | 7Yrs | 7Yrs |

| Interest rates | 8.93% | 8.93% | 9.15% | 9.15% |

How This Issue Is Different From Others:

Most of the other issues offer exit window[Buy Back] either after 5th or 7th year.This issue offers investors exit window every year after lock in period.

Exit Window[Buy Back Options]:

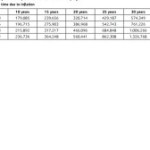

Following table shows value received on buy-back of the bonds after every year of lock in period.

| Options | 1 | 2 | 3 | 4 |

| At the end of Yr 5. | 5000 | 7,668 | Lock In of 7 Yrs | Lock in of 7 Yrs |

| At the end of Yr 6 | 5000 | 8,353 | Lock in of 7 Yrs | Lock In of 7 Yrs |

| At the end of Yr 7 | 5000 | 9,099 | 5000 | 9,228 |

| At the end of Yr 8 | 5000 | 9,911 | 5000 | 10,073 |

| At the end of Yr 9 | 5000 | 10,796 | 5000 | 10,994 |

| At the end of Yr 10. | 5000 | 11,761 | 5000 | 12,000 |

| At the end of Yr 11. | – | – | 5000 | 13,098 |

| At the end of Yr 12. | – | – | 5000 | 14,297 |

| At the end of Yr 13. | – | – | 5000 | 15,605 |

| At the end of Yr 14. | – | – | 5000 | 17,033 |

| At the end of Yr 15. | – | – | 5000 | 18,592 |

- Above table shows information about different options available for investors for buy back per bond of Rs.5000/-.Options [1] and [3] offers annual interest payments and maturity amount will be only principal amount.Buy back can be done after every year of lock in period.

- Buy Back Intimation Period:1st Jan 2017-31st Jan 2021 for 1st option and 1st Jan 2019-31st Jan 2026 for options 3 and 4.

- Buy Back date:16th March of respective year.

Currently,IFCI and REC issues are open.If anyone have special interest in company and want different options of buy back then think of this issue.

// SREI Infrastructure Finance [SIFL] has also come with infrastructure bonds from 31st Dec.2011 to 31st Jan 2012.Credit Rating is AA by CARE.Issue offers interest rate of 8.90% and 9.15% for bonds maturing of 10 and 15 years period.Face value is Rs.1000/- and min.investment is 1 bond.

How i can buy

i want to know present issued infra bond having its groth portion tax free

Finally you updated Option No.2 Details correctly.Now all details are correctly..

Thanks

Nikhil Shah

Thanks to your timely notice.

Hi..You have application Form. Go to Page No.2 ..See the details option 2 – Cumulative option. All reaming Option No.1 ; 3 & 4 are correct details..

I have made Calculation , wait for tomorrow , I am going to post on my blog..

Regards

Nikhil Shah

Hi Nikhil,

Its possible that minor differences can occur in maturity values from one calculation to another,,especially for period of 10-15 years..Calculation is more about to show how this issue is different from others.

Can one invest more than 20000 in infra bonds ? if yes what are the drawbacks of the same other than – No Tax benefit.

Hi,We can invest more than Rs.20,000,but one can get better yield in other instruments like fixed deposits as per current rates.so don’t go for more than Rs.20000/- in these bonds.Lock in period will be 5 yrs whether if have enjoyed tax benefit or not.

Thanks for the advice!!

Option No.2 – Cumulative Calculation is totally wrong. Pl remove .Pl check Option No.2 Details..

Nikhil Shah

Hello,

Thanks for your comment.Please let me know what it should be.