A.I.R. – Annual Information Returns needs to be furnished by Banks,person authorized by RBI,shares / debenture issuing companies,Registrar or sub-registrar office,Mutual funds – in respect of specified high value transactions registered by them in financial year.

Specified high value transactions are as follows:

- Cash deposits aggregating Rs. 10 Lakh or more : Bank need to report cash deposit aggregating to Rs. 10 Lakh or more in saving account in a year.

- Payment of Rs.2 Lakh or more against credit card bill: Banks / credit card issuing company need to report payment of Rs. 2 Lakh or more against payment credit card bill.

- Subscription of mutual funds worth Rs.2 lakh or more: Mutual fund trustees need to report receipt of Rs. 2 Lakh or more for acquiring mutual fund units.

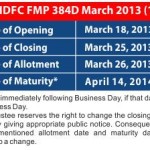

- Receipt of Rs. 5 Lakh or more for acquiring debentures or bonds:Debenture / bond issuing company will report receipt of Rs.5 lakh or more for acquiring debentures / bonds issued by company.It will also apply for investors who have applied for Tax Free Bonds for Rs.5 lakh or more.

- Receipt of Rs. 1lakh or more for acquiring shares of company.

- Purchase or sale of immovable asset worth Rs.30 Lakh or more: Office of registrar / sub registrar need to report purchase / sale transaction worth Rs.30 lakh or more.

- Receipt of Rs. 5 lakh or more for bonds issued by RBI.

All data is reported in electronic form for single as well joint transactions.

Even if high value transactions are reported to income tax department, there is no worry if transactions are authentic, taxes are paid & complete documentation , transparency is maintained.