Cost Inflation Index : Indexation is a process by which Cost of acquisition is adjusted against inflationary rise. Every year Govt notifies Cost Inflation Index which is used for calculating Long term capital gains.

When investor sells its property then CII index is used to determine current indexed value.

Govt have recently notified CII for year 2016-1017.Historical values of CII are as follows:

|

Financial Year

|

Cost Inflation Index |

| 1981-1982 | 100 |

| 1982-1983 | 109 |

| 1983-1984 | 116 |

| 1984-1985 | 125 |

| 1985-1986 | 133 |

| 1986-1987 | 140 |

| 1987-1988 | 150 |

| 1988-1989 | 161 |

| 1989-1990 | 172 |

| 1990-1991 | 182 |

| 1991-1992 | 199 |

| 1992-1993 | 223 |

| 1993-1994 | 244 |

| 1994-1995 | 259 |

| 1995-1996 | 281 |

| 1996-1997 | 305 |

| 1997-1998 | 331 |

| 1998-1999 | 351 |

| 1999-2000 | 389 |

| 2000-2001 | 406 |

| 2001-2002 | 426 |

| 2002-2003 | 447 |

| 2003-2004 | 463 |

| 2004-2005 | 480 |

| 2005-2006 | 497 |

| 2006-2007 | 519 |

| 2007-2008 | 551 |

| 2008-2009 | 582 |

| 2009-2010 | 632 |

| 2010-2011 | 711 |

| 2011-2012 | 785 |

| 2012-2013 | 852 |

| 2013-2014 | 939 |

| 2014-2015 | 1024 |

| 2015-2016 | 1081 |

| 2016-2017 | 1125 |

Significance of Cost Inflation Index:

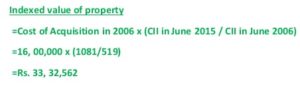

Suppose

- Ramesh purchased residential property in June 2006 :@ Rs.16 Lakh

- He sold this property in June 2015: @ Rs.60 Lakh

Then for calculating indexed value of property, CII of corresponding years will be used:

Ramesh will calculate Capital gains based on this indexed cost.

Long term Capital Gain will be calculated as:

Sale value under consideration after Expenses paid towards brokerage, advt & indexed cost of improvement

(Less)

Indexed Cost of acquisition

After Calculating capital gains, Ramesh has options as below to claim exemption from LTCG tax:

- Buy Residential property of value equivalent to capital gains.This property must be purchased either 01 yr Before OR 02 Yrs After sale of property.

- Property need to be bought on sellers name only to claim exemption.

- If investor invests in under construction property then Construction of property must be completed within 03 Yrs after sale of property.As per one of court verdict,if builder of new construction fails to hand over property within 03 yrs,exemption is still allowed.

- Invest capital equivalent to capital gains in 54EC capital bonds @6% (interest paid annually) issued by NHAI or REC, with in 06 months of sale of property.

- If entire capital gains is not invested then proportionate exemption will be allowed.

- If he decides to pay tax then he will need to pay long term capital gain tax at rate of 20% + surcharge + Cess on capital gains.

Dear Sir,

I purchased property in Bangalore in June 2008 in 30,00,000 registered value.

I sold it in May 2016 in 44,00,000 as registered value.

Please advise if any capital gain/loss applicable and how to file it in income tax.

Rgds.

Hello,

As Indexed cost will be around 58 Lakh & as sale value is less than indexed cost you won’t need to pay capital gain tax.

Considering you are salaried individual, you can use ITR 2 form to show capital gain / loss.

You can Take certified capital gain/ Loss document from qualified CA for future reference and also take its help to file the returns.

Regards.