Finance Minister of India presented union budget 2016 today and have some positive or negative implications for investors.We have taken a view on impact of budget on some important financial instruments.

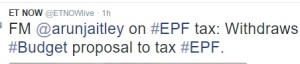

Update on 08/03/2016 :

Finance minister have announced withdrawal of budget proposal to tax EPF.

- No change in income tax slabs:There is no change in income tax slab for year 2016-2017.But for individuals whose income is not exceeding Rs. 5 lakh, ceiling of income tax rebate will be Rs.5000 instead of Rs.2000.So those tax payers will get relief of Rs.3000 in their tax liability.

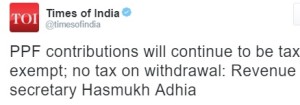

- PPF withdrawal to remain tax free: PPF which is one of the famous financial instrument will enjoy EEE status i.e.interest earned and withdrawals will be tax free.

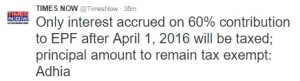

- EPF withdrawal partially taxable: Govt have tried to bring EPF in line with NPS.For contributions made after April 01,2016.. 40% of the accumulated balance will be exempt from tax.The remaining 60% (ONLY INTEREST PART) will be taxed ..making provident fund partially EET -Exempt-Exempt-Taxable from EEE.

- Tax free 40% withdrawal from NPS :40% corpus that can be withdrawn at retirement from NPS -National Pension Scheme will now be exempt from tax…Earlier withdrawal from NPS was completely taxable. More clarification from Govt related to NPS/EPF withdrawal: http://pib.nic.in/newsite/erelease.aspx?relid=137108

- No capital gains for Gold bonds: If you held Gold bonds till maturity & if there is capital gains then it will be tax free.Also if they are sold in secondary market then indexation benefit will be available.But interest earned from gold bonds will be taxable.

- Gold monetization scheme:Interest earned will be exempt from tax ..for certificates issued under Gold monetization scheme.

- 10% tax on more than 10 Lakh dividend :If dividend earned from stocks is more than 10 lakh then dividend earned above Rs.10 lakh will be taxed at 10%.It will not include dividend earned from mutual funds.But its not clear till whether mutual funds will pay tax on dividends received above Rs. 10 lakh as it will be likely to be higher than this limit.

- Additional exemption for first home buyer:Additional exemption of Rs.50,000/- for housing loan up to Rs.35 lakh subject to cost of house is not more than Rs.50 lakh.This exemption is applicable for first home buyers.

- Additional Deduction for those living in rented houses:Under section 80GG, Deduction for rent paid will be raised from Rs.24,000 to Rs.60,000 per annum.

- Proposed Reduction in service tax for single premium annuity plans: For Single premium annuity plans it is proposed to reduce service tax from 3.5% to 1.4%.