Edelweiss Housing Finance which is part of Edelweiss group offers wide range of products like Home loan,Loan against property,Refinancing,balance transfer, top up loans etc.

Edelweiss Housing finance will come up an issue of Secured NCDs worth Rs.250 Crore with an option to retain over subscription upto Rs.250 crore, aggregating size up to Rs.500 crore.

Important dates:

- Issue open date:July 08, 2016

- Issue close date:July 27, 2016.(Issue can be closed earlier if subscribed completely)

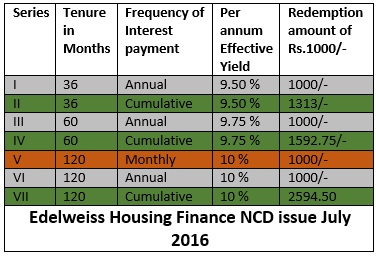

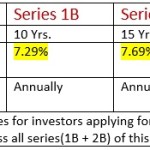

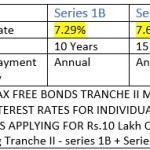

Interest Rates:

NCD offers different rate of interest as per tenure and interest will be paid annual,monthly or cumulative as below:

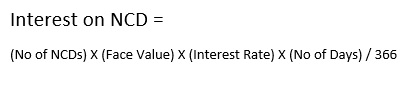

How To calculate interest for Non-Cumulative Option – Annual or Monthly interest payment:

Interest payment calculation depends on Number of days & following formula can be used to know how much interest one can get

Here,No of NCDs will be allotted as per subscription,

Face value = 1000,

Interest rate will be either 0.095,0.0975 or 0.10 as per tenure.

Other Details:

- Credit Rating:CARE AA, ICRA AA & BWR AA+ which indicates stable issue & higher safety.

- Holding of NCDs: Physical or Demat form.

- Face Value : Rs.1000/-

- Min application amount: Rs.10,000/-

- Listing : @ BSE & NSE.

- Allotment : First Come First Served – per day basis.Means if suppose issue is over subscribed on first day, then all subscribers of that day will get the proportionate allotment.

- No Call or put option.Means neither company nor investors will able to redeem NCDs before maturity.However,investor holding NCDs in demat form can sell them in secondary market at prevailing yield.

- Taxation : Interest received / accrued is taxable.Tax will be deducted at source if bonds are held in physical form & annual interest is crossed the threshold limit of Rs.5000/-.Eligible investors can provide Form 15G /15H. No TDS if NCDs are held in demat mode.

As we are in falling interest rate scenario, this NCD offers good opportunity for Fixed income investors to diversify their portfolio with good credit rating.If you are looking to invest then try to invest on first day itself as it may get over subscribed very earlier.