Generally,retail investors don’t invest in stock market for longer term or start systematic investment for short term like 03 years and then won’t renew it. Not having a goal behind investments may be one of the important reason that prevents investors from staying longer term in the market.

Considering this, Reliance mutual fund will launch Goal based investment plans Viz.Reliance Retirement Plans with two variants :Wealth Creation through Equity and Income generation through aggressive debt opportunities.

This plan will have tax benefit U/S 80C and investment will be under 05 year lock in.

Lock in period :

There will be lock in period of 05 years but this lock in period will not applicable if investor switch investment between wealth generation and income generation scheme.

Reliance Retirement Plan Wealth Creation :

It will be Equity oriented scheme with exposure in Large and Mid Cap stocks along with fixed income instruments.

Reliance Retirement Plan Income Generation :

It will be Debt oriented scheme.

Reliance mutual fund retirement fund is expected to open on January 22, 2015.

Exit Load:

As this is Retirement plan there will be exit load to discourage investors from early exit from scheme. But No exit load will be applicable if investor switch in between above mentioned schemes.Otherwise exit load of 1% will applicable if investor redeemed or stitched out investment before attaining age of 60 years.(Investor can make unlimited switches in above mentioned schemes any time even before completion of lock in period)

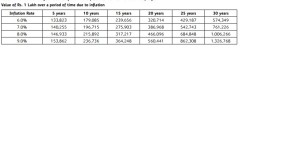

Effect of inflation:

Table below shows value of Rs 1 lakh over a period of time:

Click on image to enlarge.

Steps of Retirement Planning:

Save Prudently : Save to beat inflation over a period of time.This plan offers choice of asset classes like Equity or debt as per investors requirement.

Accumulate Retirement Corpus: Longer term view needed to generate Sufficient retirement corpus.Lo

Enjoy retirement: This fund offers different options like Systematic withdrawal or dividend payout options to enjoy liquidity.

Other mutual funds like HDFC or ICICI Prudential already have goal based products like childrens Care Plan but don’t have a great success in comparison with other general equity schemes.