Trading Volume at commodity market is growing day by day..Buying and selling of commodities is not new for us.Most of us holds commodities like Gold , Silver in physical form as well use some agri commodities day by day.

Just we will take a view of commodity future market in this post.

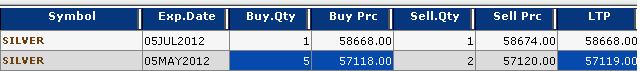

Here are some of the screen shots of commodity future terminal…Here I have chosen two most traded and leading commodities from two cateogaries i.e.Silver (precious metal) and Copper (Industrial or Base metal).

In future market,contract periods are defined and trader have an obligation to square off the position before contract expiry or take a physical delivery.Trader require to have only margin money in his account which may be in between 5-20% of the total value.

In future market we do not actually buy but BOOK the commodity at the specific price by paying off only margin or booking money.Profits and losses reflects daily in the trading account on closing basis and trader required to have prescribed margin money at any point of time.

E.g.Consider the two silver contracts in first image.One contract expires on May 05, 2012 ,which means that if any trader have position in this contract then he have option to sell it online before expiry of May 05 or take physical delivery…If he want to continue with the position then he can roll over the position in next contract ending on July 05, 2012. You can view that rates are different for two contracts and prices are higher for next contract.

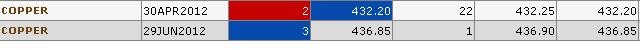

Next image is shown of copper.

Suppose I require Copper for my business….Suppose due to some reasons copper prices drops significantly upto Rs.330 per kg.As I require copper for my business, I can have some guess about the future prices and if I am of opinion that this copper price drop is temporary and prices likely to trend higher in future then I will prefer to buy the copper in future market equivalent to my requirement I have..Suppose if I have requirement of 50 MT in near term then I will buy 50 MT of copper in future market…i.e.I locked the prices at lower level.

Similar thing for copper prices at higher level.If I am copper producer and if I am sure of future price drop from current level then I will sell copper in future market and lock the prices at higher level.

One can view that currently nearby contracts ending on Apr 30, 2012 and June 29 are available for trading.As per my requirement I can take Buy or Sell position in either contract.

Price Controlling mechanism:

Future market is only the place where one can sell the commodity without actually buying it..Prices are not decided solely by buyers but by active sellers also…so future market is also considered as price controlling mechanism.

What is the risk:

Suppose I prove wrong and commodity prices trends in opposite direction than that of I guessed then I have to maintain the equivalent cash in my trading account so it require informed decision to be taken…Of course one can put the stop loss and limit the losses.

How Individual Can Benefit from the market:

Commodity market is very similar to the equity market..Any individual can open commodity trading account.

One can benefit from the intra day or short term commodity prices movements…Of course with some calculated risk only.

How Income is taxed:

Income from commodity futures market is considered as business income and added in the total income of the trader.

Disclaimer:

Commodity futures market carries significant risk.One can loose more money than available in trading account.Please judge your risk capacity before any decision.