Mr.X is looking to invest Rs 5 lakh in fixed deposits.As per general trend,he would like to make a single deposit of 5 lakh and renew or withdraw after completion of One year.

But is it write approach for today to think for short term like one year??

What is general Trend about Fixed Deposits –

Make deposit for One year or special bucket deposits which are generally about 500 days.Banks always announce such special bucket deposits in the scenarios of interest rate uncertainty or interest rates are at higher level..These deposits generally carry higher interest rates and depositor prefer to invest due to higher interest rates.

Why Now You Should Think For Longer Term – You may aware that loan growth is at lower level due to higher interest rates and number of peoples are awaiting for rates to come down and it will happen at some point of time in future so if lending rates come down then its inevitable for deposit rates to come down.Today depositor will get better interest rate for short term deposits but when it will come for renewal after the said period,chances are higher that applicable deposit rates will be lower from the current.

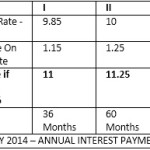

Spread Deposits for Diff Tenure – Better Approach:So better approach for today is to spread deposits across different terms.Mr X above may distribute Rs. 5 lakh as following way for different terms:

| Deposit Amount *** | Tenure | Interest Rate -% |

| 1 Lakh | 555 Days | 9.25 |

| 1 Lakh | 3 Years | 9 |

| 1 Lakh | 5 Years | 9 |

| 2 lakh | 10 Years | 8.75. |

*** – Considering deposits made at Bank Of India.

Longer tenure deposits will ensure the coverage of risk of lower interest rates in future as well short term deposits like 555 days above will offer you advantage of better interest rates.