//Shriram Transport NCD Allotment July2014:

Click Here To Check Allotment Of STFC NCD July2014.You need either Application No or DP ID-Client ID to check allotment online.Date of allotment is : July 15, 2014.

//Update as on July 03, 2014 : STFC NCD July2014 issue will be pre-closed on July 04, 2014.

//Subscription Figures OF First Day of STFC NCD July2014: check Here

Shriram Transport Finance – One of the largest Commercial Vehicle Finance company of Shriram Group will raise Rs.3000 crore through NCD issues.STFC have come with first tranche of NCD issue which will open on July 02, 2014 and company will raise Rs.1000 crore through this tranche with option of retaining over subscription up to Rs.3000 crore.

Imp Dates:

- Issue Open Date:July02,2014

- Issue Close Date:July 22, 2014.

Credit Rating :CRISILAA,CAREAA+ and INDAA+.which indicates higher safety of this issue.

Security : This issue is secured.Investors of issue will get cover equivalent to principle and interest at any point of time against immovable asset and specific future receivables of company.Charge will be created by company in favor of Debenture trustees of this issue.

Min Investment : Min investment amount is Rs.10,000 or 10 bonds.

Interest Rates and Options :

This issue offers cumulative and Non-Cumulative – Interest payment Monthly or Annually.Coupon rates for different options are as below:

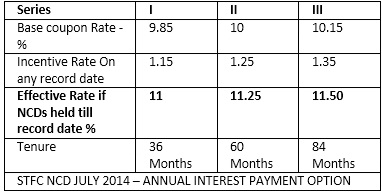

Annual Interest Payment:For Individual Investors

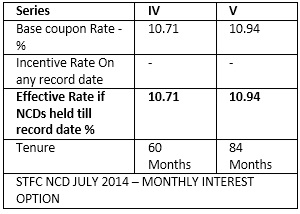

Monthly Interest Payment :For Individual Investors

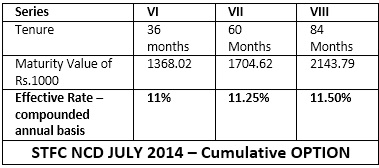

Cumulative Option:For Individual Investors

So one can check than highest rate offered is 11.50 for individual investors.

Imp Note about Monthly Interest Option :NCDs with monthly interest shall be alloted in Demat form only so investors who are looking at this option need to have demat account.

Rest for other options NCDs can held in either demat or physical mode.For Physical mode investors with annual interest or Cumulative mode – provision of TDS applicable if interest in financial year crosses mark of Rs.5000.If investor is eligible to submit 15G or 15H then he can save tax providing appropriate form.

Senior Citizen Benefits : Senior Citizens with age above 60 years will get additional yield of 0.25% per annum basis.

Shriram Transport Profit After Tax – in Crores

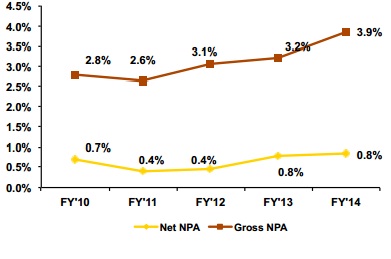

NPA Chart of STFC:

one can view NPA chart of STFC..stable.

Overall,

This issue with credit rating of AA & AA+ rating offering interest rates in the range 11- 11.50% is worth investing.company have posted consistent profits and has good reputation .

check allotment status of STFC NCD JULY 2014:

https://www.integratedindia.in/ncd_allot1.ASP

Pl note STFC July NCD issue will be closed on July 04, 2014.

First Day Subscription Figures:

1.Category I :10 crore Or 3.33%

2.Category II :0.20 crore Or 0.07%.

3.Category III:1216 Crore OR 135%

4.Category IV:340.34 Crore OR 22.69%

Overall issue size is Rs.3000 crore but company may wind up issue after subscription reached to Rs.1500 crore.

When PSU banks are providing barely 10% interest rates, its interesting to see 10+ interest rates. Here is a comparison and analysis of Shriram Transport investment options comparing NCD/ FD and stock performance. http://goo.gl/uamzTK