Rajesh recently need to undergo a surgery & his total hospital bill mounted to nearly 3 Lakh.He has mediclaim cover of 5 Lakh from his company & one may think that total bill (3 Lakh ) is below available cover limit (5 Lakh) & he may not need to spend penny from his pockel..but this is not true .Rajesh paid nearly Rs.85,000/- from his pocket.

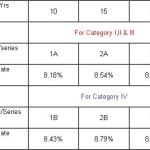

Just have a look at the total bill distribution:

Out of total medical bill,some part will not eligible for sum insured & out of total approved claim,major part will be borne by insurance company & some part by policy holder.

10% of total bill means Rs.30,000/- not eligible for settlement and needs to be totally borne by policy holder.Claim settled for Rs.2,70,000/-.

From claim settlement amount i.e. from Rs.2,70,000/- …..20% means Rs.54000/- copaid by policyholder..i.e. Rs.54,000/- paid by Rajesh is considered as copay & not entirely Rs.84,000/- paid by him..

What is Copay:

As word Copay indicates,its percentage of copayment to be paid by policy holder out of total approved mediclaim bill,though total bill is below sum insured level.

Factors Affecting Copay:

- Group insurance – Percentage of copayment depends on the mutual contract made between two parties..If there is high copay then there are chances of discounts in premium.So the percentage of copay varies from company to company & insurance providers.

- Type of service availed by policy holder : Every hospital offers different levels of services from General level to delux level..If any policy holder opting for deluxe level services then he may need to pay add on charges + higher copay….Once again it depends on contract made between two companies…Few companies offer claim up to level of Private rooms only ..if policy holder decided to opt for delux room then he need to bare the add on charges & ultimately it can result in to higher copay charges as well.

- Existing illness: Mostly existing illnesses are excluded for first 2-3 policy years..Its quite possible that thereafter insurance company will offer you claim with part of copayment from your side.In case of policies related to senior citizens,chances of higher copayment are always there.

- Type of hospital:Sometimes insurance companies categories some hospitals as costly & charge higher copay..so one need to confirm this thing as well while selecting the hospital.

- Number of claims in policy year: Sometimes few companies don’t applies copay for few initial claims but they make it mandatory after certain number of claims in the year exceeds specified limits.

As far information on copay is concerned,like percentage of copayment ,one can get this information from HR department if mediclaim from your company is there and in case of medicalim purchased by you… you need to catch your insurance agent to know the copays..

But remember that its not necessary that there will be always condition of copay..it all depends on the factors stated above.

Hi, can you please explain how much co-pay amount i should be paying if my bill amount is 3,37,000 whereas sum insured is 300,000 only. Co-payment is 20% and 7000 is not eligible for mediclaim.

would they charge 20% co-payment on total bill of 3.3L or on my eligible sum insured limit of 3L?

Sir,it will be % of max sum assured limit.

Regards.

Thanks for the info.

Can you focus some light on TPAs like which TPA works for which mediclaim company etc.

Regards,

Nisha,

One can’t say which TPA (Third Party Administrator)works for which company..One TPA can have contracts with multiple companies..Some companies like Star Health insurance have their own claim settlement system……