Here is a list of Fixed deposits offered by some of the RBI registered Non Banking Financial Services.It is recommended to check credit ratings from credit rating agencies like ICRA, CARE,FITCH. NBFCs offer some what higher rate of interest with little more risks compared to bank fixed deposits.

HDFC PLATINUM DEPOSITS:

| PERIOD(MONTHS) | RATE OF INTEREST(%)compounded p.a. | MATURITY AMOUNT OF RS.20000/- |

| 15 | 9.75 | 22466 |

| 22 | 9.55 | 23640 |

| 33 | 9.75 | 25830 |

| MIN APPLICATION: RS.20000/- | ||

| HIGHEST RATINGS FROM CRISIL(FAA)AND ICRA (MAA)0.25% EXTRA FOR SR.CITIZENS AND HDFC CUSTOMERS. | ||

SHRIRAM UNNATI DEPOSITS:

(SHRIRAM TRANSPORT FINANCE LTD)

| PERIOD(YEARS) | RATE OF INTEREST(%)compounded p.a. | MATURITY AMOUNT OF RS.25000/- |

| 1 | 9.25 | 27313 |

| 2 | 9.75 | 30115 |

| 3 | 10.75 | 33955 |

| 4 | 10.75 | 37600 |

| 5 | 10.75 | 41650 |

| MIN APPLICATION: RS.25000/- | ||

| HIGHEST RATINGS FROM CRISIL(FAA)AND ICRA (MAA) | ||

DHFL AASHRAY FIXED DEPOSITS:

DHFL AASHRAY FIXED DEPOSITS:

| PERIOD(MONTHS) | RATE OF INTEREST(%)Compounded p.a. | MATURITY AMOUNT OF RS.10000/- |

| 12 | 10.25 | 11025 |

| 24 | 10.25 | 12155 |

| 36 | 10.25 | 13400 |

| 48 | 10.25 | 14775 |

| 60 | 10.25 | 16288 |

| 72 | 10.25 | 17950 |

| 84 | 10.25 | 19800 |

| MIN APPLICATION: RS.2000/- | ||

| HIGH RATINGS FROM Care(AA+)AND BWR (FAAA) | ||

| 0.25% MORE FOR SR.CITIZENS,DEFENCE PERSONNELS,STAKEHOLDERS,DHFL BORROWERS. | ||

DHFL Fixed Deposit : 400 Days : 10.50% per annum.

DHFL Recurring Deposit:

per month : Rs. 500/- minimum.

Interest Rate: 10.25% per annum

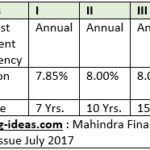

MAHINDRA & MAHINDRA FINANCIAL SERVICES:

| PERIOD(MONTHS) | RATE OF INTEREST(%)Compounded p.a. | MATURITY AMOUNT OF RS.10000/- |

| 12 | 8.5 | 10850 |

| 18 | 9.0 | 11391 |

| 24 | 9.5 | 11990 |

| 36 | 10.50 | 13495 |

| 48 | 10 | 14641 |

| 60 | 10 | 16105 |

| MIN APPLICATION: RS.10000/- | ||

| HIGHEST RATINGS FROM CRISIL(FAA). | ||

| 0.25% EXTRA FOR SR.CITIZENS /EMPLOYEES. | ||

i wish to invest Rs.50000/- in shriram transport fixed deposit. I was earlier also invested in this company FD ..will TDS applicable for ooverall interest received?

I come in 30% tax bracket.

TDS deducted if interest crosses Rs. 5000/- p.a.If you do not want to cut it Form 15G has to be submitted.But if you are already in 30% tax bracket finally tax will be payable on income.

I wish to invest Rs.25000 in HDFC platinum deposits..What is the procedure?

You can call me at 9225965529.

Pan card and address proof is requiredif not provided earlier.