Today Reserve Bank Of India reduced repo rates by 0.25% to 7.50% from 7.75%.

What is CRR,Repo Rate & Reverse Repo Rate:

CRR – Cash Reserve Ratio: As name indicates Banks need to keep certain ratio of deposits with Reserve Bank Of India which is called as Cash Reserve Ratio.Current CRR is 4% which means that if there is deposit of Rs.100,bank will able to utilize Rs.96/- for lending purpose.This is the most effective tool for RBI to increase / decrease liquidity which in turn affects the inflation.

Repo Rate:The rate at which RBI lends money to banks or other financial institutions.

Reverse Repo Rate: Its opposite to Repo rate where RBI borrow money from banks & reverse repo rates are typically 1% lower than that of Repo rates.

CRR,Repo rates directly affects the loan rates & deposit rates offered by banks & RBI need to make a balance of Growth & inflation while considering about the same.

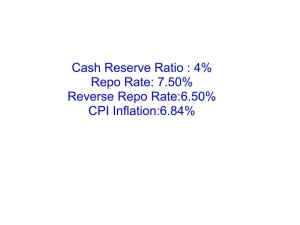

Current interest rates:

Bank Rate (Repo Rate) & Inflation comparison with other Asian countries:

We will take a view Bank rates & current CPI inflation rates with other few Asian Countries:

|

Name Of Country |

Bank Rate |

CPI Inflation Rate |

|

India – |

7.50% |

6.84% |

|

China |

6% |

3.20% |

|

Japan |

0.1% |

-0.30% |

|

Pakistan |

9.50% | 7.40% |

|

SriLanka |

7.50% | 9.80% |

|

Nepal |

9.95% | 3% |

|

Singapore |

0.04% | 3.60% |

|

Saudi Arabia |

2% | 3.90% |

|

Bangladesh |

7.25% |

7.87% |