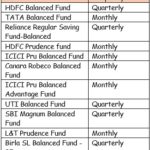

FUNDS FROM HDFC MUTUAL FUND FAMILY HAVE OUTPERFORMED THIS YEAR.

MOST OF THE FUNDS HAVE ABLE TO BEAT THE BENCHMARK.

THE RETURNS ACHIEVED BY EQUITY SCHEMES OF HDFC FUNDS ARE AS FOLLOWS:

1.HDFC BALANCED FUNDS: 17.01 %, CATEOGARY RETURNS : 9%.

2.HDFC PRUDENCE(BALANCED) : 17.09%; CATEOGARY RETURNS : 9%

3.HDFC CAPITAL BUILDER(MID-CAP) : 14.99%. CATEOGARY RETURNS : 6%

4.HDFC CHILDRENS GIFT – INVESTMENT FUND(BALANCED): 22%. CATEOGARY RETURNS : 9.11%.

5.HDFC EQUITY FUND(LARGE CAP) : 19.41%. CATEOGARY RETURNS : 9.14%

6.HDFC GROWTH FUND(LARGE CAP) : 18%. CATEOGARY RETURNS : 9.14%

7.HDFC LONGTERM ADVANTAGE(DIVERSIFIED ELSS): 15.72%, CATEOGARY RETURNS : 8.30%

8.HDFC TAX SAVER(DIVERSIFIED ELSS): 13.66% CATEOGARY RETURNS : 8.30%

9.HDFC TOP200 (LARGE CAP): 17.55: CATEOGARY RETURNS : 9.14%.