Recently Govt allowed 7 PSUs to raise Rs.40,000 crore through Tax Free bonds.As name “Tax Free bonds” indicates , interest income received from these bonds will be free from income tax.

Interest from other instruments like Fixed Deposits,NCDs is of taxable nature and so if any one has good principal amount in hand and requirement of periodic income can think for tax free bonds.

Generally these bonds are secured and back by physical assets so security may not be major issue.

Following public sector companies will raise money through Tax Free Bonds in 2015-2016

- NHAI – 24000 Crore

- IRFC – 6000 Crore

- HUDCO – 5000 Crore

- IREDA – 2000 Crore

- PFC – 1000 Crore

- REC – 1000 Crore

- NTPC -1000 Crore

Limitations of Tax Free Bonds:

- Not accumulation tool & Similar to annuity : Tax Free bonds are alike annuities where investor receive long term periodic interest payment.This is not accumulation tool.so this may not be an appropriate instrument for young investor.

- Tax Free Bonds are for long term : Tax Free Bonds are for longer term like 10, 15 and 20 yrs.so one should be little careful about requirement of money in future.Bonds held in demat mode can be sold in secondary market but low liquidity can result in very low yield than market.

Liquidity : Liquidity available through annual interest income.

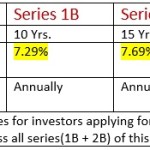

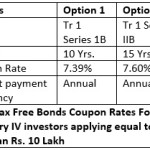

What Rate on can expect :

One can expect rates – 7.25-7.75% for this year.

Tax Free bonds Vs Immediate annuities:

Insurance companies offers immediate annuity products where investor receives – annuity (periodic income – monthly,Quarterly or Annually).If you are looking for annual interest income Tax free bonds are good instrument for long term, secure interest income and scores well above immediate annuities of insurance companies.

Tax Free Bonds Vs Fixed Deposits:

Fixed Deposit is popular saving tool and offers cumulative effect, high liquidity.Current FD rates are in the range 8 -8.50%.Interest income from FD is taxable so for individuals who are in higher tax brackets and high principal amount can invest in tax free bonds.

Tax Free Bonds Vs PPF:

Comparison between Tax Free bonds and PPF is not fair.PPF is tool of accumulation while tax free bonds offers periodic interest income.

To invest or not in these bonds is highly individually customized decision .This is one of the best instrument for Tax free,periodic, long term income but invest after considering liquidity requirements.

![Power Finance Corporation Limited [PFC]- Tax Free Bond Issue Dec 2012 -Details & Interest Rates](http://www.saving-ideas.com/wp-content/plugins/related-posts/static/thumbs/12.jpg)