SREI Infrastructure Finance Ltd – SIFL -have come up with issue of Secured,Non-convertible debentures – NCDs which will open on July 01, 2015.Company is looking to raise Rs.200 crore with option to retain over subscription up to Rs. 1000 crore.

Important Dates:

- Issue Open Date:July 01, 2015

- Issue close Date: July 20, 2015.

About SREI Infrastructure Finance Ltd:

- SREI infrastructure finance offers services to customers engaged in infrastructure development with focus on – power ,road,telecom,ports,Oil & Gas,SEZs with medium to longer term perspective.

- SREI infrastructure finance offers bouquet of products – Infrastructure project finance, Advisory & Development,Infrastructure Equipment Finance -joint venture with BNP Paribas,Venture capital,Capital Market and insurance broking.

- First Indian NBFC listed at London Stock Exchange.

- Pan India presence across India with 198 offices in India and offices in Russia & Germany.

Security : Company will offer security of specific assets with asset cover of 1 times of total outstanding amount of NCDs and interest thereon.Axis Trustee Limited is debenture trustee of issue.

Credit Rating : CARE AA- and BWR AA indicates stable issue.

Investment Options:

Issue offers different investment options – for tenures 39 months and 60 months with different interest payment options like – monthly interest payment,Annual interest payment and cumulative.

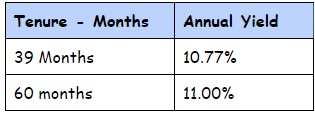

Monthly Investment option -Annual Yield for Retail Individual Investors:

Pl Note : NCDs with monthly interest payment shall be alloted in Demat form only.So demat account is must to opt for this choice.

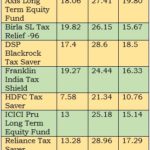

Annual Interest Option for Retail investors:

Interest to be paid out annually from date of allotment and investor can opt for physical or demat mode of allotment.

Cumulative Option:

Cumuiative interest will paid to investor at end of tenure.Retail investor will receive Rs.13,950 for 39 months and Rs.16,860 for Rs.60 months for NCDs of Rs.10,000/-.Provision of Tax deduction at source will applicable if NCDs are being held with physical mode.TDS will applicable if interest paid / accrued crosses Rs. 5000 in financial year.Investor if eligible can submit form 15G or 15H to avoid tax deduction at source.

Its always difficult to suggest whether you should invest or not in such issues.It depends on investors credit risk capacity.But interest rates being offered @11% are commensurate to credit risks.Such NCDs can offer diversification within debt portfolio so if investor have sufficient allocation in bank FDs then think to invest some part of overall fixed income in this NCD.