Currency Options at mcx-sx:

MCX-SX, which is in operation of Currency Derivatives Segment launched much awaited Currency Options for Dollar-Rupee pair today.

Exchange have recently get nod from SEBI and RBI for introduction of currency options.Exchange conducted mock trading in last week.

Currency future contracts in USD-INR,EUR-INR,JPY-INR and GBP-INR are already being traded at MCX-SX plateform.

Currency Options are the contracts that grant the buyer of the option the right ,but not the obligation to buy or sell the underlying currency at the specified exchange rate during a specific period.For this right,the buyer pays premium to the seller of the option.

Important Specifications of Currency Options:

| Symbol | USDINR |

| Unit of Trading | 1.[1 unit denotes 1000 USDs.] |

| Underlying asset | USD-INR Spot Rate |

| Tick Size | 0.10 Paisa / INR 0.0010. |

| Expiry / Last trading day | Two working days prior to the last day of expiry month at 12:15 pm. |

| Mode of settlement | Cash – Indian Rupees |

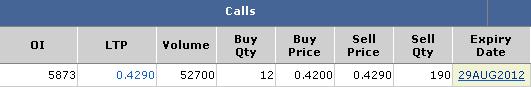

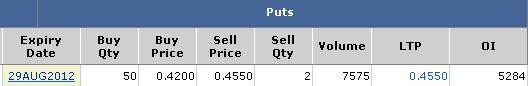

Following are the screenshots for first day trading for strike price of 55.50.

Introduction of currency options will ensure better price discovery, Cost effective risk management and increased hedge effectiveness.

Also Read: How Option Prices Are Calculated:

Do you know the approx. brokerage for currency options ?

This will help me decide whether it is worthwhile to write or buy options. Secondly, are these options liquid and do they have adequate depth at different strike price levels ?

In my experience with Nifty or Bank Nifty options the brokerage is affordable and they have good liquidity and depth as well.

Im trying to see if currency options are also good to trade. Your views or advise please.

Hi,Thanks for your comment.

Currency options are started few days back only so it will take time to enhance the liquidity.

Brokerage varies from broker to broker so you need to verify with your broker.Most of the brokers may charge per lot basis.As currency pair prices are much lower than nifty one can trade with much more less margin than NIFTY options.

If you are satisfied with NIFTY options then better to continue with it.