Today, it has become easy for companies to raise money through Non convertible debentures as equity market is not doing well..A well known and one of the oldest Kerala based Gold-loan finance company Manappuram finance is going to raise 400 cr through NCD issue with option of retaining 350 cr. over-subscription.

Key Point of this issue is that if anyone looking to lock your money for just more than 1 year i.e. 400 days then this may be suitable option for you to invest.

Manappuram finance is registered NBFC which lends money against Gold jewelery.Gold prices have increased more than 20% CAGR since last 10 years and Gold loan companies have in good profit.Also as Gold is more related with emotions,there are less chances of default.

Company have registered a growth of 70% CAGR for last 4 years. Asset under management is more than 90,000 million and there is a network of 2280 branches across India.

Issue Start date: 18th August 2011.

Issue End date: 05 th Sept 2011. Issue can be closed early if oversubscribed.

Credit ratings: CARE AA- from Care and BWR AA- from brickwork.Both ratings indicate good fundamentals and timely repayment of interest and face value.

Security:

Bonds are secured and company will secure principal,interest payable on the bond by mortagage of immovable property with debenture trustees IL&Fs Trust private limited.Security provided will be 1.10 times of the outstanding bonds at any point of time.

Face Value: Rs.1000/-.

Min. Application amount: 5 NCDs or Rs. 5000/-.

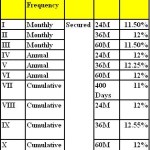

Interest Rates:-

Period Interest rate

400 Days 12% * p.a.

2 years 12.20% **p.a.

* Only cumulative option.Maturity value will be Rs.1132 per bond.

** Interest payment will be semi-annually.

Issue will be listed at BSE.

If anyone wish to invest for short term of 400 days then then can think of this issue.

the record date for the manapuram ncd(interest paid semi annualy-8th august 2011 issue)is 2/3/2012.will i get the interest if i purchase the ncd from market on 1/3/2012.please reply.

need to check.

Thanks for the feedback.

Yes, there are no immediate threats for the company as of now.

Ishita Sharma

http://www.investmentbazar.com

The rate offered by Manappuram Finance NCD is attrac¬tive and comparable to other NCDs offerings, the rating given by CARE is also positive. However the recently the company faced few issues in terms of deficiencies found by RBI in terms of routine inspection and also the promoters have pledged 20% of their total shares with Religare. Investors with a penchant of risk can consider investment in Mannapuram Finance NCD.

Read the full article – http://www.investmentbazar.com/manappuram-finance-ncd/ and many more interesting articles visit – investmentbazar

Ishita,you are right and precautions are needed while investing in any kind of NCDs or FDs.

But do not see any immediate threat for company.Promoters have pledged 20% shares but I think it is a common practice in this industry.

whether the manapuram ncd issue and muthut finance nsc issue is liable for tax exemption u/s 80c?

No.

Please guide me to invest in this issue

thanks.

Can you send me form over mail ? I am from Bangalore

only Offline forms are available with us.Please contact local broker.

I can send u the form on mail send me your mail id on ganesh.tawde@gmail.com

I want to invest Rs.25000 in this issue.Please let me know how I can get the form?

Dear Sir,If you are from Pune, send me your address and contact no on my email Id ppdeshpande123@gmail.com.

As this is public issue,i will accept the form with free home service for first 2 days only as chances of oversubscription are high within 2 days.So if you want to invest,we need to apply on first day only.