IFCI is launching Tier-2 subordinated bonds from 1 June 2011 on private placement basis.Demat account is mandatory to apply for the bonds.

Investors should not confuse it with 80-CCF infrastructure bonds.This issue do not carry 80-ccf tax benefit.

The bonds have tenure of 10 Years and 15 Years with coupon rate of 10.50 and 10.75% per annum respectively.

Details of the IFCI Issue are as follow:

- IFCI to offer 1,50,000 subordinated,Unsecured,Redeemable,Non convertible bonds series-1 of Rs.10,000/- each aggregating to Rs. 150 Crore with option to retain over subscription.

- Brickwork Ratings: BWRAA-(BWR Double A Minus). Indicates high credit quality/safety towards timely repayment of principal and interest obligations.

- Care Ratings: “A” Indicates high credit quality towards timely repayment of principal and interest.

- Demat account is compulsory to hold the bonds.

- Bond Face Value: Rs. 10,000/-

- Min application: Rs.1,00,000 (10 Bonds of Rs.10,000 Each).

- Tier-2 capital is composed of supplementory capital and mostly cateogarised as undisclosed reserves,revaluation purposes or general provisions.

- Bonds are proposed to be listed on BSE.

- Registrar: Link In Time.

- Issue Open Date: 01st June 2011.

- Issue Close Date: 15th July 2011.Closing date is tentative and subscription can be closed early.

-

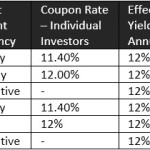

Options available to investors:

1.Annual Interest Payment //Cumulative options with tenure of 10 Years:

Interest Rate: 10.50%.Cumulative option is available for only individuals/HUFs.

Call option: At the end of 7 years from deemed date of allotment.

2.Annual Interest Payment// Cumulative options with Tenure of 15 Years:

Interest Rate: 10.75%.

Call option: At the end of 10 years from deemed date of allotment.

- Tax Benefits: As bonds are in demat mode,no TDS will be deducted.But there will not be any tax benefits.

- Mode of interest payments: ECS/At par Cheques/Demand Draft.Interest will be credited in Bank account associated with Demat account.

- Nominee of Demat account will be the default nominee of IFCI Bonds.

Invest Or Not Invest in IFCI Tier-2 Subordinated Bond Issue:

Though Bonds are of unsecured natures,IFCI ,,infrastructure finance company carries sound fundamentals.Also issue offers options of anuual interest payment as well cumulative options to choose from.

IFCI has posted a profit of 7455.30 Million for year ending march 2011 after provision of tax as compared to profit of 6930 Million for year ended march 2010.

In near term it is difficult for any banks to offer much better interest rate than that of 10.75% as lending rates are also currently high and there is not much scope to increaes in lending rates.Already Banks may face pressure on net interest margin after saving rates increased to 4% p.a.

So after keeping view of it,one can invest in this issue.

To,

ADMIN

sir,

i wish if you can give us a review of previous NCD/BONDS of SBI,HDFC,L&T FINANCE,SHRI RAM FINANCE EXTRA giving present yield if we buy thru sec. market alokwith redemption date. It will also help the liquidity of ncd market and help retired persons to invest judiciously.

thanks,

alok agrawal

Thank you for your comment.

I will try to do it..

These bonds trading at huge discount of Rs 400!

It was better to buy them now then apply and get the bond at Rs 10000!!!!!

Where are all the FII ready to buy these bonds??

What will be the tax implication on the 15 year bond with annual interest payment ? Will there be indexation benefit ?

No Indexation benefits.