SREI Infrastructure Finance company Limited – has come up with issue of Non-convertible debentures which will open on May 09, 2014.Company intends to raise Rs.150 crore through this issue and max interest rate is being offered is 12% for retail individual investors.

Imp Dates:

- Issue Open Date: May 09,2014

- Issue close Date:June 09, 2014. Pl note: this issue closed on May 19, 2014 after complete subscription.

Security : company will offer security through charge on specific assets of company with asset cover of 1.0 times of outstanding NCDs and interest at any point of time and mortgage on immovable property.

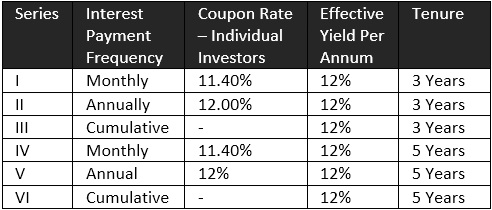

Interest Rates and Other Details:

For monthly interest payment option,allotment will be on in Demat form only.

This issue offers Two investing tenures Viz 36 months and 60 months with monthly or annual interest payment and cumulative option.

Maturity Value for cumulative option will be Rs.1405.40 and 1705.90 for period of 03 yrs and 05 years respectively.

Credit Rating : CARE AA- and BWR AA.Both indicates good credit quality and high safety.

Highlights of SREI:

- Manages More than 3 Lakh crores of AUM.

- SREI has PAN India presence with 198 offices across India and overseas presence at Russia and Germany.

- SREI is the only private infrastructure finance company with IFC -Infrastructure Finance Company status.

- Listed company at BSE,NSE and London Stock Exchange.

- SREI is in major Equipment finance business in joint venture with BNP Paibas.

0.25% Extra for Existing Investors and Share holders:

Existing NCD holders and Share holders to get 0.25% extra above rates mentioned above.Benefit will be available as on record date.

Debenture Redemption Reserve:DRR

As per new companies act,its necessary for companies to keep reserve of at least 15% of total NCDs maturing in the financial year through Debenture Redemption Reserve.Such reserve can be created through profits made by company.This reserve can be set up upto April 30 of each year.So if company is in profit then it will create DRR in each financial year when NCDs are due to mature and this reserve can be used only for debenture redemption purpose.

Overall,this issue offers a good interest rate considering credit rating of AA- which indicates high safety and can invest a small part of fixed income portfolio in this issue.At the same time investors should aware that any company engaged in lending business can not be free from credit risk and consider about risk capacity before investing.