Gilt Funds:Gilts funds invests in the securities offered by Central Govts of different maturities & those offered by State Govt.

As Gilt funds invests in Govt securities,investment can be called as free from credit risk & there is no chance of default.

Where do Gilt Funds Invest:

- Govt Of India Securities.

- State Govt securities.

- Treasury Bills.

- Call money market – as provided by RBI to meet the liquidity requirements.

- Cash.

Mutual funds generally have two types of Gilt Funds:

- Short Term Gilt Funds : Generally invests in securities maturing up to period of three years.

- Long Term Gilt Funds: Long term Gilt funds can have maturity profiles of more than three years.

Are Gilt Funds Safe:

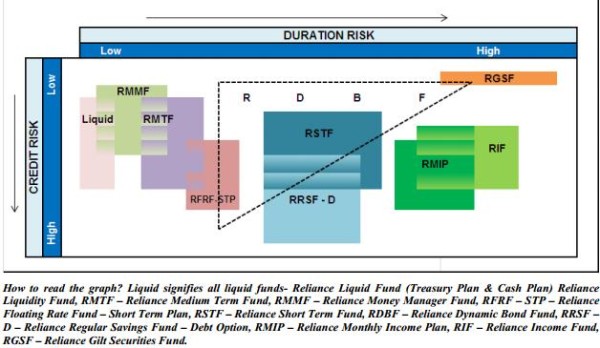

Though there is very low credit risk they can carry interest rate risk.Comparative positioning of Gilt Fund with other debt funds can be like this:

Source: Reliance Mutual fund website: www.reliancemutual.com

In above chart one can view that RGSF – Reliance Gilt Securities Fund carries lowest credit risk but since avg maturity of securities can be for longer period it can carry high interest rate (or duration) risk.

One can check that RIF (Reliance Income fund) carries same duration risk but also carry high credit risk compared to Gilt funds.

Can Gilt Funds Have lower NAV than preceding day:

Answer is yes. NAV of Gilt funds can go down for short term.E.g. if you check returns of Gilt funds for last one month,most of the funds have offered either marginal or negative returns.

Ultimately invest in Gilt funds only if investment duration is more than 12 months & there are chances of lower interest rates ahead.

Gilt funds are better alternative for income funds if you want to minus the credit risk.