Arbitrage funds are slowly gaining popularity among investor.At least increasing Assets under arbitrage funds suggests so.Today,we will take view of arbitrage funds,benefits & associated risks.

Arbitrage fund generates income by taking advantage of arbitrage opportunities(simultaneous buy-sell mis-prized securities) that exists between Cash & derivative market.

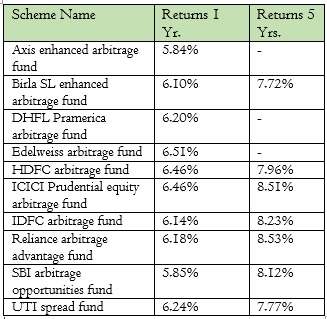

Most of the asset management companies have arbitrage funds and few are as listed below:

Returns (CAGR)of last 01 year and if investor have entered before 05 years…indicates reducing returns with time.

What is risk associated with arbitrage opportunities:

1.Reducing arbitrage opportunities:If arbitrage funds continuously get high inflows,arbitrage opportunities may get reduced with time & it can impact the returns.If you have checked above table,returns of last year are much lower.Arbitrage funds are virtually risk free but may not be in reality.

2.Higher turnover :Due to simultaneous buy-sell transaction,arbitrage funds can have a high transaction cost which can impact the returns.

Benefits of arbitrage funds:

1.Tax free Redemption:Arbitrage funds have taxation similar to equity.So as per current taxation laws,if units are held for more than one year, capital gain tax will be nil.

2.Low volatility: NAVs are less volatile and standard deviations may be around 0.5-0.6.so there are less chances of capital erosion if held for period like one year.

Arbitrage funds can be good idea for high tax bracket individuals.Investor can get tax benefits but it will not generate any significant returns.For Investors who are in low tax brackets,arbitrage funds are not suitable & they can prefer to invest in liquid or ultra short term funds.