Value parameters like P/E – price to earning or P/B – price to book value, dividend yields used to determine current state of market.Means how it is valued.After recent market correction there is debate every where about investing based on value parameters.

There are number of mutual fund schemes adopt investment strategies based on P/E , P/B ratios. such funds decides debt-equity allocation based on these parameters.

Here we have selected Franklin dynamic P/E ratio fund which dynamically reset allocation on monthly basis.

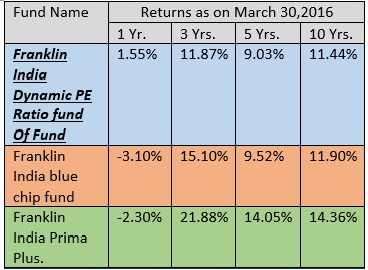

Comparison of Franklin Dynamic P/E ratio Fund of fund scheme: with Franklin India blue chip and Franklin India prima plus which is large cap oriented multi-cap fund.

Franklin P/E ratio fund of fund invests dynamically based on P/E ratio model .Equity – Debt allocation is done in Franklin India Blue chip fund & Franklin India short term income fund.

- PE ratio fund can provide temporary relief for short term when market is in downside.

- If P/E ratio model was successful then in long term like 10 yrs, returns of Franklin dynamic PE funds should have been much more higher.

- For longer term, P/E based funds can miss the rallies and actively managed funds can do better.

- Funds like ICICI Prudential Dynamic fund invests based on P/BV and accordingly manages allocation.But we have not seen out-performance in comparison with other equity funds.

Concluding,

- Equity funds have mandate of investing in equities.Their job is to select fundamentally strong businesses and remain invested irrespective of market condition.

- Investor should stick to asset allocation.Along with equity fund they can invest in debt funds.They can always switch to equity funds if P/E levels are favorable.

- Dynamic allocation funds can provide lower standard deviation but it can compromise returns as well.

- Stock selection is a key : In long term,” stock selection” is key and its not how much equity fund is holding.