Tax Saving Mutual Funds: Investor can invest in Tax saving mutual fund scheme known as ELSS – Equity Linked Saving Scheme and avail tax benefit u/s 80C. Typically these are equity oriented mutual funds which invests at least 80% of corpus in equities.

Key benefits of Tax Saving Mutual Funds:

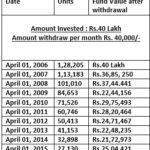

- 03 yr lock in period which is least among 80C tax saving instrument.

- No long time / periodic commitments as it can be one time investment.

- Generally any tax saving mutual fund scheme declares dividend once in a year (its not guaranteed) if dividend option is opted.So some liquidity is possible.

- Tax free capital gains and dividends.

- Long term Growth potential with commensurate risk.

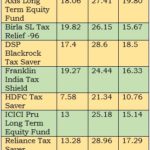

All mutual fund houses have at least one mutual fund scheme.We have selected 03 mutual fund schemes with consistent track record.

- Axis Long Term Equity Fund: This fund was launched in Dec, 2009.Earlier it was known as Axis Tax Saver which was renamed as Axis Long Term Equity Fund in 2011.This fund has excellent blend of different sectors like Banking,Automotive,Pharma,IT,Engineering,Chemicals,Food & beverages.This fund has consistent performance record with lower than average volatility and NAV deviation.

- Franklin India Tax Shield:This is one of the oldest fund which was launched in April 1999.This fund has diversified sector allocation like Banking,Automotive,Technology,Pharma,Engineering,Telecom.

- ICICI Prudential Long Term Equity Fund (Tax Saving):This fund was launched in August , 1999 as ICICI Prudential Tax Saver Fund which was renamed as ICICI Prudential Long Term Equity fund (Tax Saving) in Sept 2015.This is large cap oriented multicap fund having exposure in Banking,Technology,Pharma,Automotive,Metal & Mining sector.

Risk Profile is very important Factor:

Investors risk profile is very important consideration.As returns of any mutual fund scheme are market dependent, we can not run away from market risk.Its possible that your mutual fund won’t give any returns within lock in period.so before investing, keep appropriate investment horizon like 5 to 10 years.

Summarizing, tax saving mutual funds can offer growth potential over other fixed income tax saving instruments like PPF, but risk profile of investor is also important.Invest if you can digest volatility of equity market.