Edelweiss will launch Banking ETF – Exchange Traded Fund on Dec 14, 2105.ETF will track bank Nifty movement and offer returns closely resemblance to it.

Since it is ETF, Demat account is mandatory.

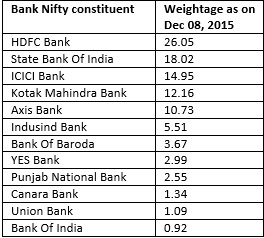

Bank Nifty constitutes bunch of private & PSU Banking stocks.Current bank Nifty constituents and their weightage in Bank Nifty is as follows:

As stocks and their weightage is dynamic factor, there will be tracking error from ETF side.

Other Banking ETFs available:

- Goldman Sachs Banking BeEs fund

- R* Shares Banking ETF.

- SBI ETF Nifty Bank Fund.

Banking Mutual Funds Vs Bank ETFs:

- Banking Funds are actively managed and have flexibility to allocate weightage of their choice.Most of the banking funds have allocation in private banks over public sector banks.

- Expenses of banking funds can be up to 2.5 -3% while bank ETF expenses are capped up to 1.5%.But ETFs will have brokerage as an additional cost.

- Apart from banking stocks, bank mutual funds have mandate to invest in stocks of Non-banking finance and listed insurance companies.so their is scope of more diversification.

ETFs are better for risk management against dividual stocks:

If investor is looking for exposure in banking sector then bank ETF can be a good option rather buying individual stocks.It can minimize the concentration risk.

Edelweiss Bank Nifty will open and close on Dec 14, 2015.thereafter it will be listed on or before Dec 22,2015.