DS Kulkarni – DSK Developers – NCD Issue August 2014 .

Company will raise Rs.100 crore with option to retain over subscription of same amount – total aggregating Rs.200 crore.Company will utilize the issue proceedings for different projects viz.DSK Vishwa AnandGhan,DSK Nandanvan,DSK Mayurban and DSK Dream City Phase -I..located in and around Pune city.

DSK is listed at both NSE and BSE with current market cap at about 177 crore and networth about 501 crore.

Imp Date:

- Issue Open Date: August 04, 2014.

- Issue Close Date:August 26, 2014.

Security :company will provide security cover in term of Land – covering principal and interest amount at any point of time by creating charge in favor of debenture trustees.

This issue offers different interest payment frequencies like – Monthly,Quarterly,Annually and Cumulative.

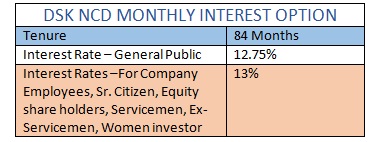

Monthly Interest Option:

In this option interest payment frequency will be monthly and Tenure will be 84 months.Coupon rate for General public is 12.75% and 13% for other investors like DSK employees,Senior Citizens,Equity holders,Women investors ,Servicemen ,Ex-servicemen.

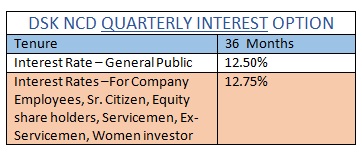

Quarterly Interest Option:

Tenure:36 Months.

Coupon Rate For General Public: 12.50%

Rate For other preferred investors:12.75%.

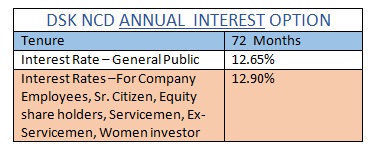

Annual Interest Option:

Tenure:72 Months.

Coupon Rates:12.65%

Rate for other preferred investors: 12.90%

Cumulative option:

Principal and interest payable at maturity with yield of 13.43% CAGR.Redemption amount will be exactly doubled for this option after 66 months.

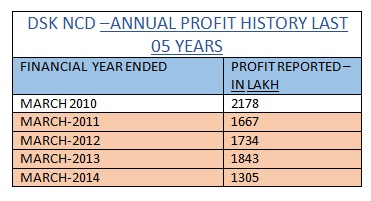

Profit of company since last 05 Yrs:

Is Premature withdrawal Possible:

There is no call -put option available.so neither company nor investor would have exit except maturity.Investors who have opted for physical mode will not have any exit option except maturity.For demat mode,NCDs are tradable at BSE and can be sold online if buyer is available for the same.

Credit Rating : BBB+ Which indicates medium safety of issue.

Credit rating is generally decided based on past,present and future fundamentals of company.Whole real estate sector have went through trouble since last few years.DSK is well known trusted company and I think there won’t be trouble if one invests small amount in this issue.

subscription Figures-14-08-2014:

Retail Category:90% subscribed.

Overall-subscription..73%.

subscription Figures-12-08-2014:

Retail Category:76% subscribed.

Overall-subscription..62%.

Hi. Is there an option to buy the issue through demat? Couldn’t find on icici..

Hi,most of the time such issues r available through demat account.Not sure about icici direct. But one can apply offline & provide demat account details.

Thank you

First Day subscription Figures:Retail Category:9.74% subscribed for first day..

higher demand for Series I -36 month quarterly interest payment option

followed by 84 Month Monthly Interest payment option.

I Want to interested for the new NCD purchase

can you send me full details of the how to proses to invest my money

please send my E mail id

sandip.kothimbiure@rediffmail.com

Dear Sandip,

You can contact nearer stock broker for application form.

Thank you.

Hi, firstly thanks for the info, but it is missing some information, will you please address it

1. There is no mention of minimum investment

2. No mention of NCD units multiples of which we can purchase

3. No mention of who give the BBB+ rating and up to what extent

4. No mention of revenue for those years and what was the profit margins

5. No mention of who will be the debenture trustees

6. No mention of yield

7. No mention of any specific reason for reduction of profit and it’s current cash flow, debt equity ratio

8. No Comparison of performance of similar entity in the same industry

hope you’ll add more information to make it more informative, anyway once again thanks

Thanks Prasad for points mentioned.

You are true saying few points are missing.

Here we generally won’t focus much on analysis or any specific advise…. so will not be able to comment much on specific reasons on net operating profits,margins or debt equity ratio.

Few points we can cover are:

1.Min Investment : Rs.25,000 combining all NCDs across all series.

2.Face value is Rs.5000 except for annual interest option where face value is 25,000… investor can invest in multiple of face value.

3.CARE BBB+ rating is for size of this issue.

4.As far profit margins are considered,company have reported better net margins for financial year ended march – 2013…which was about 32%..Vs.avg 8-11% for previous years.

5.GDA Trusteeship limited is trustee of this issue and can be contacted by investors if there is any kind of default by company.While Link In Time is issue registrar which can be contacted in case of any servicing issue.

6.No mention of yield as coupon rates are provided.Investors can refer to application form for yields across different series.

8.No idea about any debenture issue of any similar entity.

Thank you once again.