Muthoot Finance – the largest Gold Loan company from India has come up with an NCD issue in Dec-2013 which will open on Dec27,2013 for subscription.Muthoot Finance will raise Rs. 250 crore with an option to retain over subscription of same amount aggregating to 500 Crores.

Imp Dates:

- Issue Open Date:Dec 27, 2013.

- Issue Close Date:Jan 27, 2014.

Interest Rates and other Details:

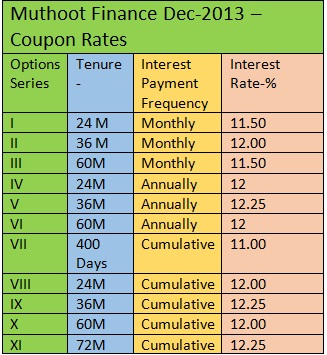

Interest rates for individuals ,HUFs and HNIs are as follows:Other investors will get 0.50% lower interest rates.

So one can view that highest interest rate of 12.25% available for investment period of 36 months and 72 Months.

Security : Options I to X are of secured nature while option XI is unsecured nature and its subordinate or Tier-II category.

Credit Rating : AA- from CRISIL and ICRA.

Mode Of Holding : NCDs of Options VII to XI can be held only in demat form while options I to VI can be held either in Demat or physical mode.

Positive Points for Company:

- Company have posted good results since last few years .

- Retail client base.

- Recent RBI guidelines allow Gold loan up to only 60% of Gold value which can result in low NPAs even if Gold prices come down in future .. there is already higher safety allowance.

- Applied for bank license and already have required infrastructure , especially in rural or semi rural areas.If Muthoot finance get bank license then cost of borrowing will come down in future.

- Venture in other businesses like white Label ATMs.

Concerns for Muthoot Finance:

- RBI directions of 60% loan can have impact on loan disbursement .

- High cost of borrowing : As muthoot finance can not raise money through Deposits it has high cost of borrowing through NCD medium.

- Though there is safety allowance,impact of fluctuation in Gold prices is there.

Updates as on 09-01-2014 : w.e.f.January 09,2014 RBI have allowed Loan to Value ratio of 75% against earlier 60% as mentioned above.This is positive development for Gold loan companies as it will help companies to disburse more loan.

Overall, if you can afford to take some credit risk then coupon rates are good enough to invest.

Also View:

IRFC Tax Free Bonds January 2014