Govt Of India have decided to launch Inflation indexed Saving bonds to retail investors considering the erosion of saving due to inflation and investors more inclination towards Gold which is generally considered to be hedge against inflation.

Details of Inflation Indexed National Savings Securities- Cumulative, 2013 are as follows:

- As word cumulative indicates,principal and interest aggregate amount will received on maturity only..though there are provisions made for premature withdrawal.

- Issue will available from Dec 23, 2013 to Dec 31, 2013..RBI have option to close issue before last date considering response to this issue.

- Eligibility for Investment:The Bonds may be held by an individual( not being a Non-Resident Indian)-

- in his or her individual capacity, or

- in individual capacity on joint basis, or

- in individual capacity on anyone or survivor basis, or

on behalf of a minor as father/mother/legal guardian.

- Limit of Investment:Minimum limit for investment in the bonds is Rs.5,000/- and maximum limit for investment is Rs.5,00,000/- per applicant per annum

- Tax Treatment:Income Tax: Interest on the Bonds will be taxable under the Income-Tax Act, 1961 as applicable according to the relevant tax status of the bonds holder.Means interest will added in income of investor and will be taxed according to tax slab of investor.

- The Bonds will be issued for a minimum amount of Rs.5,000/- (face value) and in multiples thereof.

- Subscription:Subscription to the Bonds will be in the form of Cash/Drafts/Cheques/online through internet banking. Cheques or drafts should be drawn in favour of the bank payable at the place where the applications are being submitted.

- Date of Issue:The date of issue of the Bonds in the form of Bonds Ledger Account will be opened (issued) from the date of receipt of funds/realization of draft/cheque

- Applications for the Bonds in the form of Bonds Ledger Account can be submitted at: Branches of State Bank of India, Associate Banks, Nationalised Banks, three private sector banks (i.e. HDFC Bank Ltd., ICICI Bank Ltd., AXIS Bank Ltd.) and SHCIL during their working hours.

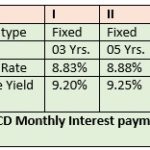

- Interest:The Bonds will bear interest at the rate of 1.5% (fixed rate) per annum + inflation rate calculated with respect to final combined Consumer Price Index [(CPI) Base; 2010 = 100]. Final combined CPI will be used with a lag of three months to calculate incremental inflation rate . Interest will be compounded with half-yearly rests and will be payable on maturity along with the principal.

- Tradibility:The Bonds shall not be tradable in the secondary market. The Bonds shall be eligible as collateral for loan from banks, Financial Institutions and Non-Banking Financial Company (NBFC). The lien to that effect will be marked in the depository (RBI) by the authorised banks

- Maturity Repayment : The Bonds shall be repayable on the expiration of 10 (ten) years from the date of issue. The investor will be advised by the authorised bank one month before maturity regarding the ensuing maturity of Bonds advising them to provide a Letter of Acquaintance, confirming the NEFT/NECS account details, etc. to the authorised bank. If everything is in order, the investor will be paid within maximum five days of the maturity

- Premature withdrawal: Early repayment/redemption before the maturity date is allowed after one year of holding from the date of issue for senior citizens, i.e. 65 and above years of age and for all others, after 3 (three) years of holding, subject to the penalty charges at the rate of 50% of the last coupon payable. Early redemption to be allowed only on coupon date.

So overall,its quite difficult to predict inflation rate in future and so the overall returns on inflation indexed bonds…basic purpose of such bonds was to offer investors some alternative to Gold ..to curb Gold imports..Lets see how investors shall respond to inflation indexed bonds.