There may not be second opinion about importance of Emergency fund.There may be emergency in any form like health,accident,sudden job loss or any thing similar.

so its important to build the emergency fund and it should be any ones first priority to build up the required emergency fund.

How much emergency fund do you need:

Exact answer for this question is too much difficult.Its depends on which kind of lifestyle you are leaving..how much you are earning but by thumb of rule one may have emergency fund equivalent to expenses of six months.Suppose monthly expenses are Rs.50,000 then emergency fund can build will be around Rs.3 lakh.

How To Build The Emergency Fund:

- First step one can take is to open the separate joint saving account along with spouse / parents and make frequent contribution in this account till your estimate is reached.Its important to open account with other family members as they also need to have an access for this account under emergency situation.Suppose if I have an accident then things may become difficult if only I have an access to this account.

- Prefer to have account mentioned above with bank offering higher saving rate like Kotak mahindra or Yes bank which are offering you with interest rate of 6-7%.One can also invest some money in short term deposits linked with this account if interest rates are better.

- Start Recurring deposit with your saving account.Current recurring deposit rates are around 8.50 – 9% and for building the corpus of 2.5 lakh within one year one may need to have RD of just below Rs.20000/- per month.

- Start SIP in liquid funds.If SIP period is about one year then liquid funds is best option.

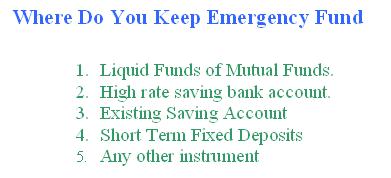

As per my opinion Liquid funds from mutual funds are best to build the emergency fund.

Its better to build the emergency fund within shorter period of time like within 12-18 months as emergency can be there at any point of time.

One should look towards Emergency fund as risk management tool.Having emergency means a having a risk & one can better manage the risk by having prepared for it.

Suppose I am travelling in bus and what will happen if suddenly I found a big hole in my pocket??But I will be relieved instantly if I have some money kept at inner pocket considering this emergency situation?

so finally

- how you are looking to develop your emergency fund?

- What do you think how much emergency fund is sufficient for you?

- Where do you keep your emergency fund?

- Which instrument will you prefer to build the emergency fund?