If you have checked SBI Deposit rates for Senior citizens in recent times then one may find big disappointment. SBI have scrapped additional benefit for senior citizens for deposits up to one year completely & its offering only 0.25% extra to senior citizens for deposits maturing above one year.

Most of the senior citizens depends on interest income ..& so its cause of concern for them.

Interest rates of Senior Citizen Saving Scheme (SCSS) are currently better than SBI deposit rates stands at 9.20%.Good thing is that RBI have not cut CRR ..so immediate reduction of deposit rates are low for now.

// Please Note: w.e.f. May 2013, IDBI have reduced additional Senior Citizen benefit from 0.75% to 0.50%.

Other PSUS like PNB,UCO bank have also reduced extra interest rate benefits for senior citizens up to 0.25%.

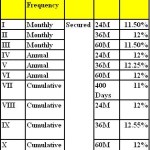

We have taken a view of senior citizen interest rates for a period Of One Year:

| Sr.No | Bank Name | Sr Citizen Deposit rate – One Yr Period | Additional Rate Offered to Senior Citizens Above Card Rates. |

| 1. | Allahabad Bank | 9.50% | 0.25% ** |

| 2. | Andhra Bank | 9.50% | 0.50% |

| 3. | BOB | 9.25% | 0.50% |

| 4. | BOI | 9.50% | 0.50% |

| 5. | BOM | 9.50% | 0.50% |

| 6. | Canara Bank | 9.50% | 0.50% |

| 7. | Central Bank Of India | 9.50% | 0.50% |

| 8. | Corporation Bank | 9.50% | 0.50% |

| 9. | Dena Bank | 9.50 | 0.50% |

| 10. | IDBI | 9.50 | 0.75% |

| 11. | Indian bank | 9.50% | 0.50% |

| 12 | IOB | 9.50 | 0.50% |

| 13. | OBC | 9.50% | 0.50% |

| 14. | PSB | 9.50% | 0.50% |

| 15. | Syndicate | 9.50 | 0.50 |

| 16. | Union Bank | 9.50% | 0.50% ** |

| 17 | UCO Bank | 9.35% | 0.25% |

| 18. | United Bank Of India | 9.25% | 0.50% |

| 19. | Vijaya Bank | 9.25%(9.50% for Special V-Sanman Scheme) | 0.25% |

| 20. | PNB | 9.25% | 0.25% |

| 21 | SBI | 9% | 0.25% |

** Information on exact additional benefits for senior citizens is not available on the website.

IDBI is currently offering additional rate of 0.75% for senior citizens for period above one year & Bank Of India is as well offering benefit of higher interest rate of 0.70% for deposit period in bet 5 Yrs to 08 Yrs…& 0.80% higher for period between 08 Yrs to 10 Yrs.

One can view that SBI which is the biggest PSU bank in India,is currently offering lowest rates of interest for Senior citizens..what do you think..is it cause of concern for senior citizens???