There are possibly two types of mutual fund investors:

- New investors who wish to start investing.

- Existing investors.

How To Select Mutual Fund By New Investors:

- Type Of Fund: While investing first time,one should start invest through equity diversified fund and avoid sectoral types of fund.In equity diversified funds fund manager can choose the combination of sectors depending on their choice and can minimize the risk in greater way.Combination of equity diversified fund,Large cap and midcap fund is a good idea.

- Fund Performance:This is also an important criteria for fund selection.Performance of all schemes is available at respective sites of mutual funds as well at the mutual fund research related sites.One can check the performance for last 5yrs,3yrs and one year.Its important to compare the performance with the benchmark or similar type categoric fund.

- Performance in downside:Check the performance of the fund in severe market downside.Its important criteria as aggressive types of fund deeps down by higher margin and may be avoided.

- Overall fund house performance:Its also necessary to check the overall performance of the fund house.If only single fund of that particular fund house is doing good job and others are worst performers then one should think twice about investing in such fund…as performance can be mere fluke.

- Rest as far I think don’t need to give extra importance for things like expense ratio as this factor is inclusive of daily NAV declared and already part of the fund performance.

- We also do not give much importance for name of fund manager as fund manager alone do not run the fund.He has to abide by the strategies and research of the that particular fund house.

Tips For Existing Investors:

- Review of the fund portfolio:If you have look at the things listed above while selecting the funds then you are on right track already otherwise try to do review of the funds for above parameters and optimise the things by removing the unnecessary funds and opting for required one.Most of the investors may have a query about period of such reshuffle or review.As far I think there should not be any time constraints but have your own judgement to do it.

- Don’t Run Behind The Best:As far I think its not possible for any single fund to remain consistantly on the top..If you try for different funds for their performance for last 1,3 or 5 yrs then most of the times there are names of different funds.We are on the highway with a number of mutual fund schemes around,a little bit up and down is easily possible.Suppose,if my fund have offered me 15% for last one year,benchmark offered 10% and best performer have offered 18%,then I don’t think I have a need of any reshuffle.

- Don’t Remain In The Worst Fund:If your fund is consistantly ranked down,they its meaningless to remain in such fund.Suppose,my fund have offered me returns of 8% for last 1 year,Benchmark have offered 13% and best performers have offered suppose 18% then I will take a view for next few funds and till if there are no signs of improvement then I will quit.

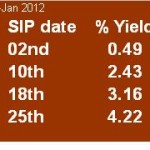

- Don’t Rely Mere On SIP:Success of the systematic investment (SIP)is highly depend upon the flow pattern of the market.If market is too strong when you are paying the installments and If it is is too weak when you have actual requirement of money then chances are high that you may get lower returns that you have expected…so try to have some lumpsum investments when market have sudden dips.

Finally,one should know the basic purpose of investing through mutual funds..Its not to achieve the greater returns but it is to minimize the risk in comparison with the individual stocks,, as we are investing through pool of money and we are investing our few thousand rupees in number of stocks and achieving the diversification.. So what do you think for your mutual fund investment?You may have your own opinions to share then why not to share below….