Asset allocation is the most basic principal of investing.Proper asset allocationcan lead to higher returns with minimum risk.Asset allocation can be defined as proper distribution of capital among different types of segments.Investors can choose the securities based on risk assessment,liquidity,Age and capacity of investing.

Equity:

One can invest in equities with two different ways

1.Direct equity:

Investors can invest in shares of different companies.Investors who can able to devote time to study the stocks can directly invest in stocks.Risk and return potential is high.

2.Mutual Funds:

Rather than directly investing in stocks,investors who are not able to study share market can invest through mutual funds.Each equity mutual fund carries a number of stocks depending on objective and leads to more diversification.

Risk /Return potential is high.

Commodities:

Commodities involve precious as well industrial metals.Precious metals involves Gold and silver while holding of industrial metals involves copper,Nickel,Lead and Zinc.Similar to stocks commodities offers high returns and carries higher risks.Only advantage of commodities is that each commodity have its own unique uses and can never be delisted from market which is possible for any of the stock.

Debt:

Debt securities offer fixed rate of interest for a particular periods.It normally consists of

1.Fixed Deposits:

Fixed deposits offered by banks offers fixed rate of interest for particular period.These are safe products with lower return potential.

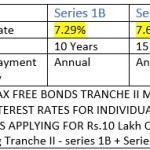

2.Bonds:

It is a contract between two parties which offers fixed rate of returns. Risk / rewards are medium.

3.Money market instruments:

These are normally short term maturing (within 1 yr generally) securities.

As already stated asset allocation depends upon nature of the individual and can be cateogarised in three different ways.

1.Aggressive portfolio:

Equity + Commodity : 80 – 100%

Debt : 0-20%.

2.Moderate Portfolio:

Equity + Commodities: 50%

Debt: 50%.

3.Conservative portfolio:

Equity + Commodities: 0-20%.

Debt: 80-100%.

% allocation is indicative and minor changes are possible.

It is necessory to take review of portfolio after some definite period and need to rebalance it.Rebalancing involves exit from high/worst performing securities,addition of newer securities etc.