Investors can invest in Gold through ETFs as well through e-gold of national spot exchange.There are some minor differences in ETF and e-gold.

1.Fund managers track Gold prices through Net Asset Value(NAV).NAV of Gold ETF is net of liabilities.so NAV and returns of different ETFs are different.

While in NSEL e-gold investors directly tracks gold prices.

2.NAV of ETFs are inclusive of custodian charges.while NSEL do not charge any holding charges.

3.In e-gold ,investors are directly holding the gold units ,,,while in Gold ETfs gold is actually owned by mutual fund AMCs.

4.Physical delivery in small denominations is possible in e-gold.while in gold etfs physical delivery depends on sole discretion of ETFs.

ETFs may offer delivery for investors holding Gold of higher amount.

5.We can invest in gold etf only upto 3:30 PM IST as market get closed.while spot market is open till midnight and we can invest in e-gold series till 11:30 PM.Suppose if gold ETF closed with NAV of 2300 (Time : 3:30 pm) and get closed at e-gold at 2330(At 11:30 pm).Then there is a difference of Rs.30 per gram in both the prices.Gold ETF will try to cover up this difference on opening itself.Investors will not get opportunity to get the price inbetween.

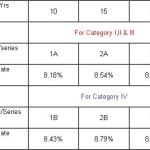

6.In both cases,buy-sell intraday/delivery brokerages are payable which are in general in the range of 0.3 to 1%.

I want hold gold for long term but i want to know which is best option and secure option for me ETF/ e-gold ?

Kindly let me know do i need Demat account / NSDL account and which is cheap and best option for me.

Good points, another pro to ETFs is the cost-saving provided by not having to take physical delivery or storage: http://www.bestonlinebrokerage.com/gold-prices-top-1900/. What do you think of the relationship between speculation and higher commodity prices?